Overstock.com 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

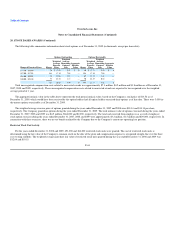

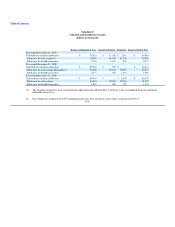

26. DECONSOLIDATION OF VARIABLE INTEREST ENTITY

In April 2004, the Company entered into an agreement which allowed the Company to lend up to $10.0 million to an entity for the purpose of buying

diamonds and other jewelry, primarily to supply a new category within the jewelry department which allowed customers purchasing diamond rings to select

both a specific diamond and ring setting. Under the agreement, the Company was to receive fifty percent (50%) of any profits of the entity. In addition, the

Company had a ten year option to purchase ("Purchase Option") 50% of the ownership and voting interest of the entity. The exercise price of the Purchase

Option was the sum of (a) one thousand dollars, and (b) $3.0 million, which may have been paid, at the Company's election, in cash or by the forgiveness of

$3.0 million of the entity's indebtedness to the Company.

The entity was evaluated in accordance with FASB ASC Topic 810-10-65-2, Consolidation of Variable Interest Entities, and it was determined to be a

variable interest entity for which the Company was determined to be the primary beneficiary. As such, the financial statements of the entity were consolidated

into the financial statements of the Company.

In November 2004, the Company loaned the entity $8.4 million. The promissory note bore interest at 3.75% per annum. Interest on the loan was due and

payable quarterly on the fifteenth day of February, May, August and November, commencing on November 15, 2004 until the due date of November 30,

2006, on which all principal and interest accrued and unpaid thereon, was due and payable. The promissory note was collateralized by all of the assets of the

entity.

In November 2006, an unrelated third party purchased the Company's interests in the variable interest entity by executing a promissory note to the

Company in exchange for termination of all agreements between the Company and the variable interest entity. The promissory note was equal to the net assets

of the entity or $6.7 million and bore no interest. The first payment on the note receivable was due and paid on February 1, 2007 in the amount of $3.7 million

with remainder of balance due in twelve equal monthly payments of $251,000 beginning on March 1, 2007. In September 2007, the Company amended the

note receivable deferring the final six monthly payments from February 1, 2008 to July 1, 2008. During the years ended December 31, 2007 and 2008, the

Company received payments on the note totaling $5.2 million and $1.5 million, respectively. The promissory note was completely satisfied as of

December 31, 2008.

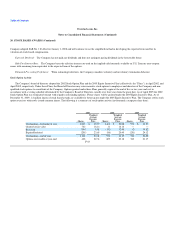

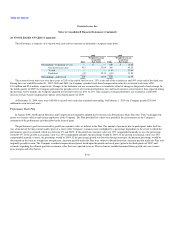

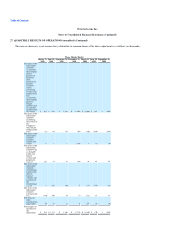

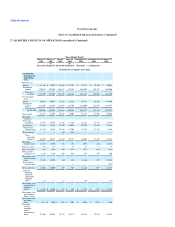

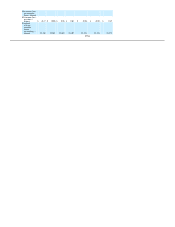

27. QUARTERLY RESULTS OF OPERATIONS (unaudited)

As discussed in the Note 3, on January 29, 2010, the Audit Committee of the Board of Directors of the Company concluded, based on the

recommendation of management, that the Company would restate its quarterly consolidated financial statements for all interim periods for the year ended

December 31, 2008 and the interim periods ended March 31, 2009, June 30, 2009 and September 30, 2009 within this Form 10-K to correct the following

errors:

Accounting for amounts that the Company pays its drop ship fulfillment partners and an amount due from a vendor that went undiscovered for a

period of time. Specifically, these errors related to (1) amounts the Company paid to partners or deducted from partner payments related to return

processing services and product costs and (2) amounts the Company paid to a freight vendor based on incorrect invoices from the vendor. Once

discovered, the Company applied "gain contingency" accounting for the recovery of such amounts, which was an inappropriate accounting

treatment.

F-50

•