Overstock.com 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

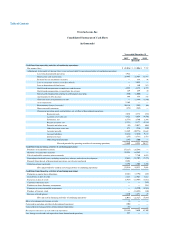

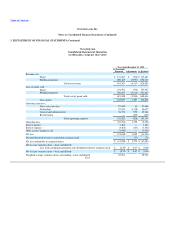

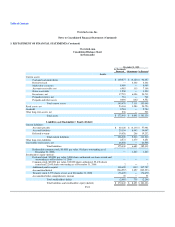

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

2. ACCOUNTING POLICIES (Continued)

Revenue recognition

The Company derives revenue primarily from two sources: direct revenue and fulfillment partner revenue, including listing fees and commissions

collected from products being listed and sold through the Auctions tab of its Website as well as advertisement revenue derived from its cars and real estate

listing businesses, and from advertising on its shopping pages. The Company has organized its operations into two principal segments based on the primary

source of revenue: Direct revenue and fulfillment partner revenue (see Note 25—"Business Segments").

Revenue is recognized when the following revenue recognition criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has

occurred or the service has been provided; (3) the selling price or fee revenue earned is fixed or determinable; and (4) collection of the resulting receivable is

reasonably assured. Revenue related to merchandise sales is recognized upon delivery to the Company's customers. As the Company ships high volumes of

packages through multiple carriers, it is not practical for the Company to track the actual delivery date of each shipment. Therefore, the Company uses

estimates to determine which shipments are delivered and therefore recognized as revenue at the end of the period. The delivery date estimates are based on

average shipping transit times, which are calculated using the following factors: (i) the shipping carrier (as carriers differ in transit times); (ii) the fulfillment

source (either the Company's warehouses or those of its fulfillment partners); (iii) the delivery destination; and (iv) actual transit time experience, which

shows that delivery date is typically one to eight business days from the date of shipment.

The Company evaluates the criteria outlined in ASC Topic 605-45, Principal Agent Considerations, in determining whether it is appropriate to record

the gross amount of product sales and related costs or the net amount earned as commissions. When the Company is the primary obligor in a transaction, is

subject to inventory risk, has latitude in establishing prices and selecting suppliers, or has several but not all of these indicators, revenue is recorded gross. If

the Company is not the primary obligor in the transaction and amounts earned are determined using a fixed percentage, revenue is recorded on a net basis.

Currently, the majority of both direct revenue and fulfillment partner revenue is recorded on a gross basis, as the Company is the primary obligor. The

Company presents revenue net of sales taxes.

The Company periodically provides incentive offers to its customers to encourage purchases. Such offers include current discount offers, such as

percentage discounts off current purchases, and other similar offers. Current discount offers, when used by customers, are treated as a reduction of revenue.

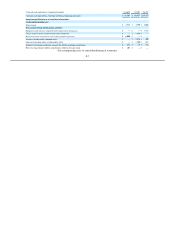

Co-branded Credit Card

During the years ended December 31, 2007, 2008 and 2009, the Company had a co-branded credit card agreement with a third-party bank, for the

issuance of credit cards bearing the Overstock brand, under which the bank paid the Company fees for new accounts, renewed accounts and for card usage.

New and renewed account fees are recognized as revenues on a straight-line basis over the estimated life of the credit card relationship. Credit card usage fees

are recognized as revenues as actual credit card usage occurs. The Company's co-branded credit card agreement with the third-party bank terminated effective

August 30, 2009.

F-14