Overstock.com 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

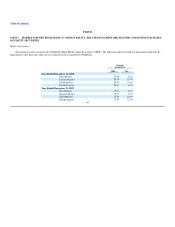

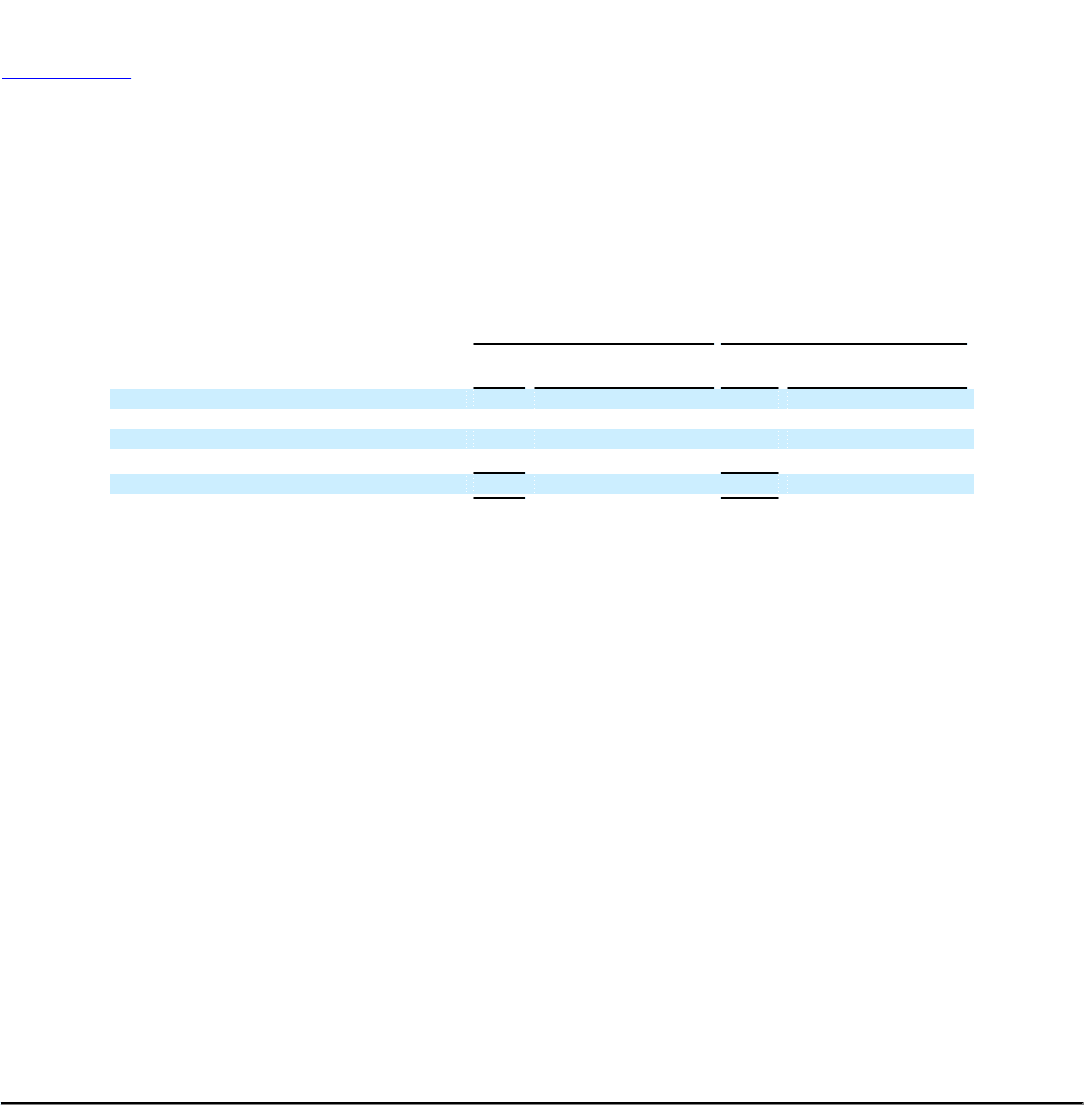

Restricted stock units activity

During the years ended December 31, 2008 and 2009, 491,000 and 366,000 restricted stock units were granted. The cost of restricted stock units is

determined using the fair value of our common stock on the date of the grant and compensation expense is recognized on a straight line basis over the three

year vesting schedule. The weighted average grant date fair value of restricted stock units granted during the years ended December 31, 2008 and 2009 was

$12.64 and $10.15, respectively.

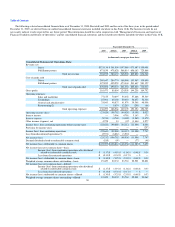

The following is a summary of restricted stock unit activity (amounts in thousands, except per share data):

2008 2009

Units

Weighted Average

Grant Date

Fair Value Units

Weighted Average

Grant Date

Fair Value

Outstanding—beginning of year — $ — 449 $ 12.69

Granted at fair value 491 12.64 366 10.15

Vested — — (110) 12.64

Forfeited (42) 12.13 (65) 11.55

Outstanding—end of year 449 12.69 640 11.35

Restricted stock units vest over three years at 25% at the end of the first year, 25% at the end of the second year and 50% at the end of the third year.

During the years ended December 31, 2007, 2008 and 2009, we recorded stock based compensation related to restricted stock units of $0, $1.4 million and

$2.6 million.

At December 31, 2009, approximately 640,000 restricted stock units were outstanding. On February 1, 2010, we granted 250,000 additional restricted

stock units.

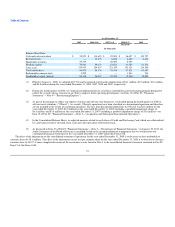

ITEM 6. SELECTED FINANCIAL DATA

Restatement

As discussed in Item 15 of Part IV "Financial Statements"—Note 3—"Restatement of Financial Statements", on January 29, 2010, the Audit Committee

of the Board of Directors concluded, based on the recommendation of management, that we would restate (1) our consolidated financial statements for the

year ended December 31, 2008 and (2) our quarterly consolidated financial statements for all interim periods for the year ended December 31, 2008 and the

interim periods ended March 31, 2009, June 30, 2009 and September 30, 2009 within this Form 10-K to correct the following errors:

Accounting for amounts that we pay our drop ship fulfillment partners and an amount due from a vendor that went undiscovered for a period of

time. Specifically, these errors related to (1) amounts we paid to partners or deducted from partner payments related to return processing services

and product costs and (2) amounts we paid to a freight vendor based on incorrect invoices from the vendor. Once discovered, we applied "gain

contingency" accounting for the recovery of such amounts, which was an inappropriate accounting treatment.

Amortization of the expense related to restricted stock units. Previously the expense was based on the actual three year vesting schedule, which

incorrectly understated the expense as compared to a three year straight line amortization. We also corrected for the use of an outdated forfeiture

rate in calculating share-based compensation expense under the plans.

The following additional adjustments were also included in this restatement:

Correction of certain amounts related to customer refunds and credits.

48

•

•

•