Overstock.com 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Item 15 of Part IV, "Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations"). Interest expense is largely related to interest

incurred on our Senior Notes, and to a lesser extent our capital lease obligations. Interest expense for the years ended December 31, 2008 and 2009 totaled

$3.6 million and $3.5 million, respectively.

Other income, net. For the year ended December 31, 2009, other income was $3.3 million, which relates primarily to gains from the early

extinguishment of a portion of our 3.75% Convertible Senior Notes ("Senior Notes"). For the year ended December 31, 2009, we retired a total of $7.4 million

of our Senior Notes for $4.6 million in cash and recorded a $2.8 million gain, net of amortization of debt discount of $92,000.

For the year ended December 31, 2008, other income (expense) was net expense of $(1.4) million. This included a $2.8 million gain, net of amortization

of debt discount of $142,000 on the retirement of $9.5 million of the 3.75% Senior Notes (see Item 15 of Part IV, "Financial Statements"—Note 19—"Stock

and Debt Repurchase Program"), a $3.9 million loss on the settlement of notes receivable (see Item 15 of Part IV, "Financial Statements"—Note 5

—"Acquisition and Subsequent Discontinued Operations") and a $300,000 other-than-temporary impairment of marketable securities.

Sale of discontinued operations

On January 21, 2009, we entered into a Note Purchase Agreement to settle both the senior and junior promissory notes related to the sale of our travel

subsidiary to Castles Travel, Inc. for $1.3 million in cash and recognized a loss on the settlement of these notes and interest receivable of approximately

$3.9 million which was recorded in other income (expense), net during the year ended December 31, 2008 (see Item 15 of Part IV, "Financial Statements",

"Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations"). We agreed to the reduced amount for the notes due to concern

regarding the financial viability of the entity holding the notes, as a result of the impact of the economic downturn on the travel industry that began during the

latter part of 2008.

Income taxes

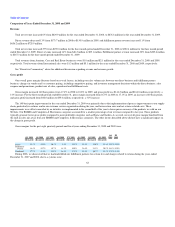

Our provision for income taxes for the year ended December 31, 2009 of $257,000 is for federal alternative minimum taxes and state taxes. As of

December 31, 2008 and 2009, we had net operating loss carry forwards of approximately $166.1 million and $160.4 million and state net operating loss carry-

forwards of approximately $145.8 million and $140.1 million, respectively, which may be used to offset future taxable income. An additional $15.9 million of

net operating losses ("NOLs"), related to the acquisition of Gear.com, are limited under Internal Revenue Code Section 382 to $799,000 a year plus any

excess over limitations not utilized in prior years. The annual limitation available in a given year for NOLs subject to IRC Section 382 is the product of the

Company's value on the date of ownership change and the federal long-term tax-exempt rate.

Seasonality

Based upon our historical experience, revenue typically increases during the fourth quarter because of the holiday retail season. The actual quarterly

results for each quarter could differ materially depending upon consumer preferences, availability of product and competition, among other risks and

uncertainties. Accordingly, there can be no assurances that seasonal variations will not materially affect

66