Overstock.com 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

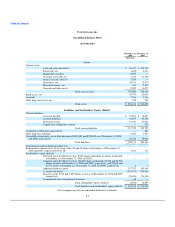

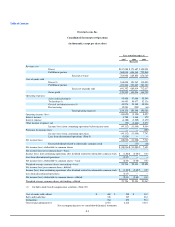

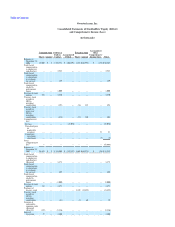

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

2. ACCOUNTING POLICIES (Continued)

Restricted cash

The Company considers cash that is legally restricted and cash that is held as a compensating balance for letter of credit arrangements as restricted cash.

At December 31, 2008 and 2009, restricted cash was $4.3 million and $4.4 million and was held primarily in money market accounts.

Marketable securities

Marketable securities consist of funds deposited into capital management accounts at one financial institution. The Company generally invests excess

cash in short- to intermediate-term fixed income securities and money market mutual funds, including municipal, government and corporate bonds which are

classified as available-for-sale marketable securities on the consolidated balance sheets and are reported at fair value using the specific identification method.

Realized gains and losses are included in other income (expense), net in the consolidated statements of operations. Unrealized gains and losses are excluded

from earnings and reported as a component of accumulated other comprehensive income (loss), net of related tax effect.

The Company periodically evaluates whether declines in fair values of its investments are other-than-temporary. This evaluation consists of a review of

qualitative and quantitative factors, including quoted market prices, if available, other publicly available information, or other conditions that bear on the

value of its investments. At December 31, 2008, gross unrealized gains on marketable securities were $48,000. The Company recorded an "other than

temporary" impairment of marketable securities of $300,000 and realized losses of $34,000 during the year ended December 31, 2008 and realized losses of

$48,000 during the year ended December 31, 2009. The Company had no marketable securities at December 31, 2009.

Fair value of financial instruments

The Company's financial instruments, including cash, cash equivalents, notes receivable, accounts receivable, accounts payable and accrued liabilities are

carried at cost, which approximates their fair value because of the short-term maturity of these instruments.

The Company accounts for its assets using a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable

or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company's market

assumptions. These two types of inputs have created the following fair-value hierarchy:

Level 1—Quoted prices for identical instruments in active markets;

Level 2—Quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active,

and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

Level 3—Valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

This hierarchy requires the Company to minimize the use of unobservable inputs and to use observable market data, if available, when determining fair

value.

F-9

•

•

•