Overstock.com 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

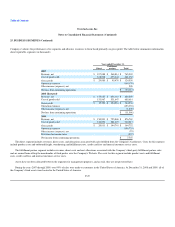

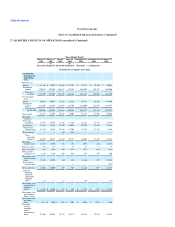

23. INCOME TAXES

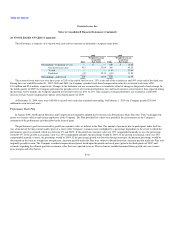

The provision for income taxes consists of the following (in thousands):

Year ended December 31, 2009

Current:

Federal $ 145

State 112

Total current 257

Deferred:

Federal —

State —

Total deferred —

Total provision for income taxes $ 257

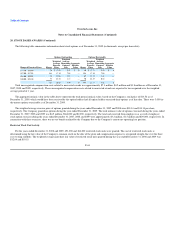

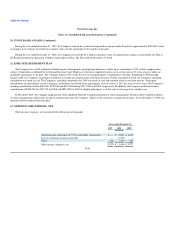

The components of the Company's deferred tax assets and liabilities as of December 31, 2008 and 2009 are as follows (in thousands):

December 31,

2008 2009

Deferred tax assets and liabilities:

Net operating loss carry-forwards $ 71,908 $ 68,755

Temporary differences:

Accrued expenses 5,365 4,246

Reserves and other 4,115 5,667

Depreciation 5,055 1,577

86,443 80,245

Valuation allowance (86,443) (80,245)

Net asset $ — $ —

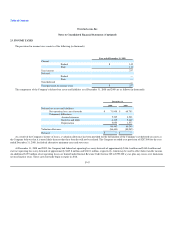

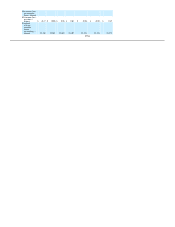

As a result of the Company's history of losses, a valuation allowance has been provided for the full amount of the Company's net deferred tax assets as

the Company believes that it is more likely than not that these benefits will not be realized. The Company recorded a tax provision of $257,000 for the year

ended December 31, 2009, for federal alternative minimum taxes and state taxes.

At December 31, 2008 and 2009, the Company had federal net operating loss carry-forwards of approximately $166.1 million and $160.4 million and

state net operating loss carry-forwards of approximately $145.8 million and $140.1 million, respectively, which may be used to offset future taxable income.

An additional $15.9 million of net operating losses are limited under Internal Revenue Code Section 382 to $799,000 a year, plus any excess over limitations

not used in prior years. These carry-forwards begin to expire in 2018.

F-47