Overstock.com 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

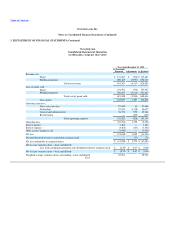

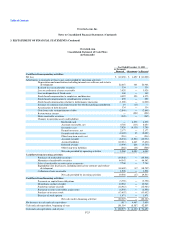

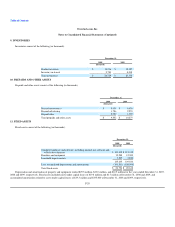

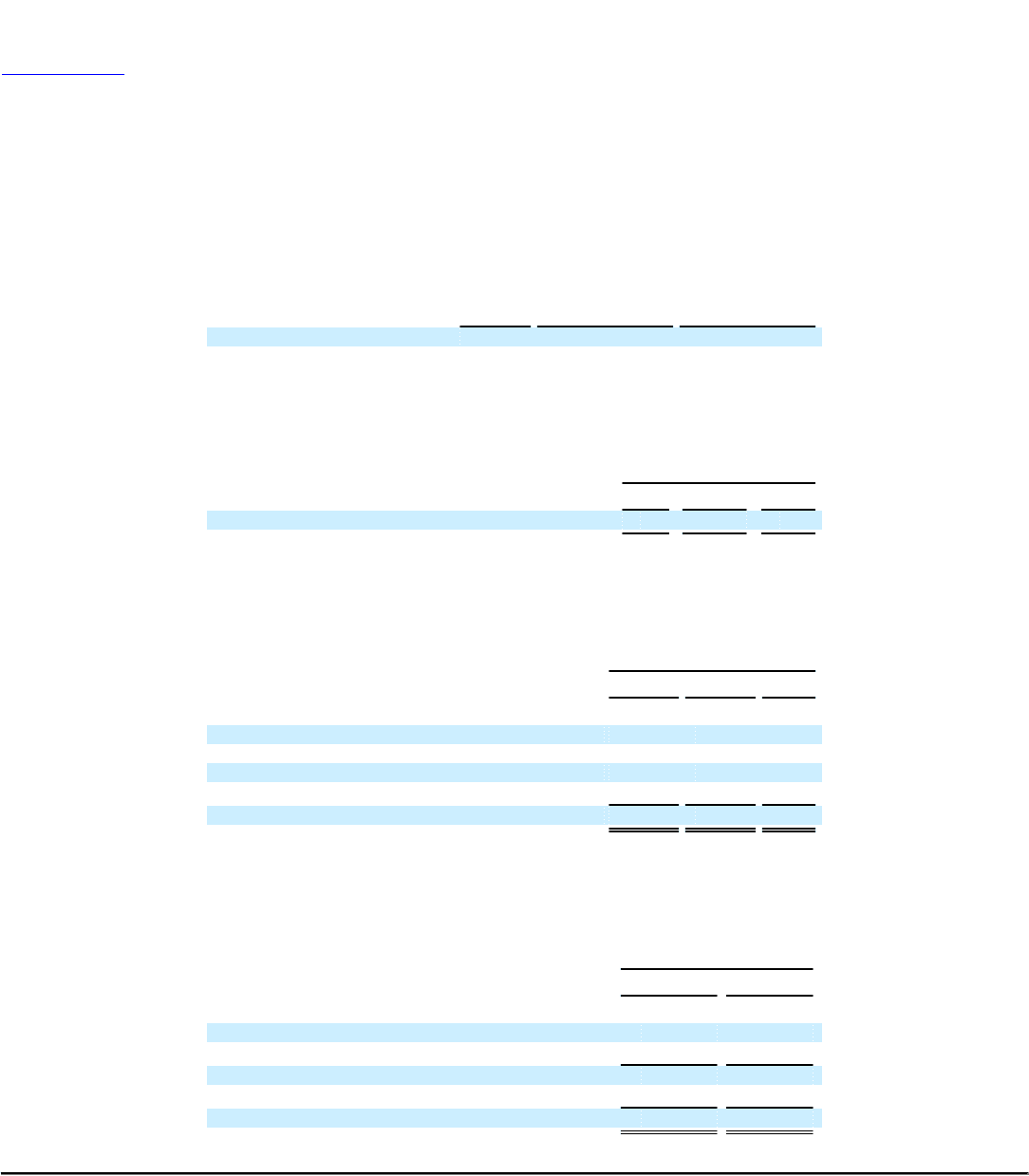

6. MARKETABLE SECURITIES (Continued)

The following table summarizes the Company's marketable security investments as of December 31, 2008 (in thousands):

Cost Net Unrealized

Gains Estimated Fair

Market Value

Marketable securities:

U.S. Agency Securities $ 8,941 $ 48 $ 8,989

The components of realized losses on sales and impairment of marketable securities for the years ended December 31, 2007, 2008 and 2009 were (in

thousands):

Years ended December 31,

2007 2008 2009

Net realized loss on sales of marketable securities $ — $ (334) $ (48)

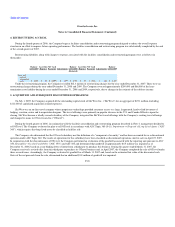

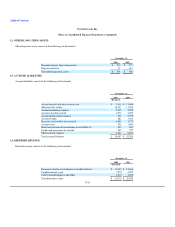

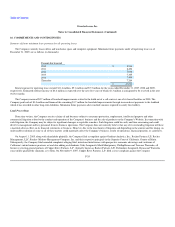

7. OTHER COMPREHENSIVE LOSS

The Company's comprehensive income (loss) is as follows (in thousands):

Year ended December 31,

2007 2008 2009

(Restated)

Net income (loss) $ (48,036) $ (11,006) $ 7,747

Net unrealized gain on marketable securities 41 48 —

Reclassification adjustment included in net income — — (48)

Cumulative translation adjustment (3) 94 —

Comprehensive income (loss) $ (47,998) $ (10,864) $ 7,699

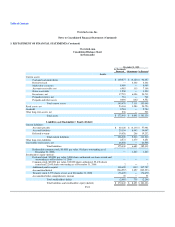

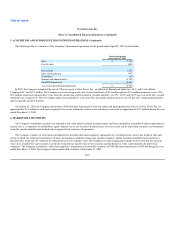

8. ACCOUNTS RECEIVABLE

Accounts receivable consist of the following (in thousands):

December 31,

2008 2009

(Restated)

Credit card receivable $ 4,057 $ 5,949

Accounts receivable, other 4,637 7,421

8,694 13,370

Less: allowance for doubtful accounts (1,594) (1,730)

Accounts receivable, net $ 7,100 $ 11,640

F-28