Overstock.com 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

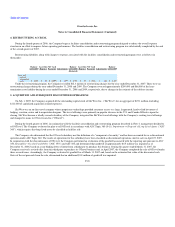

2. ACCOUNTING POLICIES (Continued)

Income taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis using

enacted tax rates in effect for the year in which the differences are expected to affect taxable income. The effect on deferred tax assets and liabilities related to

a change in tax rates is recognized in income in the period that includes the enacted date.

Deferred tax assets are evaluated for future realization and are reduced by a valuation allowance to the extent the deferred tax asset will not be realized.

The Company considers many factors when assessing the likelihood of future realization of its deferred assets including expectations of future taxable

income, the carry-forward periods available for tax reporting purposes, the reversals of our deferred tax liabilities and other relevant factors. At December 31,

2008 and 2009, the Company has established a full valuation allowance against its deferred tax assets, net of expected reversals of existing deferred tax

liabilities. Significant judgment is required in making this assessment, and it is very difficult to predict when, if ever, the Company's assessment may conclude

that the remaining portion of the deferred tax assets are realizable.

Foreign currency translation

For the Company's subsidiary located in Mexico, the subsidiary's local currency was considered its functional currency. As a result, all of the subsidiary's

assets and liabilities were translated into U.S. dollars at exchange rates existing at the balance sheet dates, revenue and expenses were translated at weighted

average exchange rates, and stockholders' equity was recorded at historical exchange rates. The resulting foreign currency translation adjustments were

recorded as a separate component of stockholders' equity (deficit) in the consolidated balance sheets as part of accumulated other comprehensive income

(loss). Transaction gains and losses were included in other income (expense) in the consolidated financial statements and were not significant for any period

presented. The Company's subsidiary was located in Mexico and ceased operations on October 24, 2008.

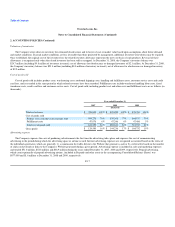

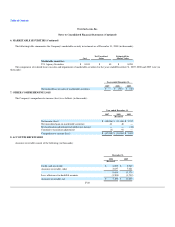

Earnings (loss) per share

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to common shares by the weighted average number of common

shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income (loss) attributable to common shares for the period

by the weighted average number of common and potential common shares outstanding during the period. Potential common shares, comprising incremental

common shares issuable upon the exercise of stock options, restricted stock units and convertible senior notes are included in the calculation of diluted net

income (loss) per common share to the extent such shares are dilutive.

F-19