Overstock.com 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

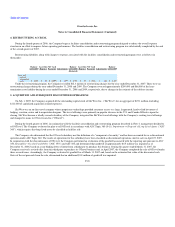

2. ACCOUNTING POLICIES (Continued)

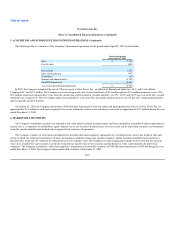

Stock-based compensation

The Company measures compensation expense for all outstanding unvested share-based awards at fair value on date of grant and recognizes

compensation expense over the service period for awards expected to vest on a straight line basis. The estimation of stock awards that will ultimately vest

requires judgment, and to the extent actual results differ from estimates, such amounts will be recorded as an adjustment in the period estimates are revised.

Management considers many factors when estimating expected forfeitures, including types of awards and historical experience. Actual results may differ

substantially from these estimates (see "Note 20—Stock Based Awards").

Loss contingencies

In the normal course of business, the Company is involved in legal proceedings and other potential loss contingencies. The Company accrues a liability

for such matters when it is probable that a loss has been incurred and the amount can be reasonably estimated. When only a range of possible loss can be

established, the most probable amount in the range is accrued. If no amount within this range is a better estimate than any other amount within the range, the

minimum amount in the range is accrued.

Restructuring

Restructuring expenses are primarily comprised of lease termination costs. ASC Topic 420, Exit or Disposal Cost Obligations, requires that when an

entity ceases using a property that is leased under an operating lease before the end of its term contract, the termination costs should be recognized and

measured at fair value when the entity ceases using the facility. Key assumptions in determining the restructuring expenses include the terms that may be

negotiated to exit certain contractual obligations (see "Note 4—Restructuring Expense").

F-18