Overstock.com 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

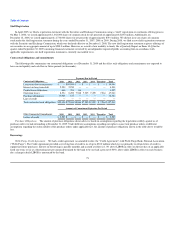

Other income, net. Other income (expense) for the year ended December 31, 2007 was $(92,000). For the year ended December 31, 2008, other income

(expense) was $(1.4) million. This included a $2.8 million gain, net of amortization of debt discount of $142,000 on the retirement of $9.5 million of the

3.75% Senior Notes (see Item 15 of Part IV, "Financial Statements"—Note 19—"Stock and Debt Repurchase Program"), a $3.9 million loss on the settlement

of notes receivable (see Item 15 of Part IV, "Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations") and a $300,000 other-

than-temporary impairment of marketable securities.

Sale of discontinued operations

We determined during the fourth quarter of 2006 to sell our travel subsidiary ("OTravel"). As a result, OTravel's operations were classified as a

discontinued operation and therefore are not included in the results of continuing operations. The loss from discontinued operations for OTravel was

$6.9 million and $3.9 million for the years ended December 31, 2006 and 2007, respectively.

In conjunction with the discontinuance of OTravel, we performed an evaluation of the goodwill associated with the reporting unit pursuant to ASC

Topic 350, Intangibles—Goodwill and Other ("ASC 350") and ASC Topic 360-10-15, Impairment or Disposal of Long-Lived Assets ("ASC 360") and

determined that goodwill of approximately $4.5 million was impaired as of December 31, 2006 based on a non-binding letter of intent from a third party to

purchase this business. On April 25, 2007, we completed the sale of OTravel for cash proceeds of $9.9 million, net of cash transferred, and $6.0 million of

notes. Based on the estimated fair value of the discounted cash flows of the net proceeds from the sale, we recorded an additional goodwill impairment of

$3.8 million in 2007. (see Item 15 of Part IV, "Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations").

On January 21, 2009, we entered into a Note Purchase Agreement to settle both the senior and junior promissory notes to Castles Travel, Inc for

$1.3 million in cash and recognized a loss on the settlement of these notes and interest receivable of approximately $3.9 million which was recorded in other

expense as of December 31, 2008 (see Item 15 of Part IV, "Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations").

Income taxes

For the years ended December 31, 2007 and 2008, we incurred net operating losses, and consequently paid insignificant amounts of federal, state and

foreign income taxes. As of December 31, 2007 and 2008, we had net operating loss carry-forwards of approximately $164.2 million and $166.1 million,

respectively, which may be used to offset future taxable income. An additional $15.9 million of net operating losses are limited under Internal Revenue Code

Section 382 to $799,000 a year. These net operating loss carry-forwards will begin to expire in 2018.

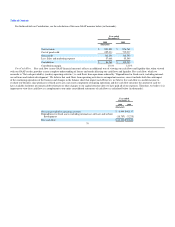

Liquidity and capital resources

Historical sources of liquidity

Prior to the second quarter of 2002, we financed our activities primarily through a series of private sales of equity securities, warrants to purchase our

common stock and promissory notes. During the second quarter of 2002, we completed our initial public offering pursuant to which we received

approximately $26.1 million in cash, net of underwriting discounts, commissions, and other related expenses. Additionally, we completed follow-on offerings

in February 2003, May 2004 and November 2004, pursuant to which we received approximately $24.0 million, $37.9 million and $75.2 million, respectively,

in cash, net of underwriting discounts, commissions, and other related expenses. In November 2004, we also received $116.2 million in proceeds from the

issuance of our

71