Overstock.com 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

2. ACCOUNTING POLICIES (Continued)

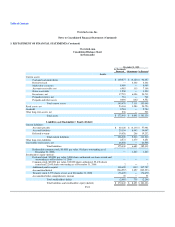

Valuation of inventories

The Company writes down its inventory for estimated obsolescence and to lower of cost or market value based upon assumptions about future demand

and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

Once established, the original cost of the inventory less the related inventory allowance represents the new cost basis of such products. Reversal of these

allowances is recognized only when the related inventory has been sold or scrapped. At December 31, 2008, the Company's inventory balance was

$24.7 million (including $9.8 million of inventory in-transit), net of allowance for obsolescence or damaged inventory of $2.1 million. At December 31, 2009,

the Company's inventory balance was $23.4 million (including $8.0 million of inventory in-transit), net of allowance for obsolescence or damaged inventory

of $2.2 million.

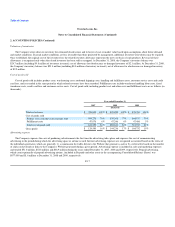

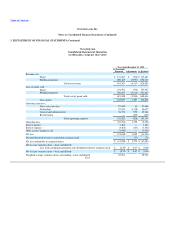

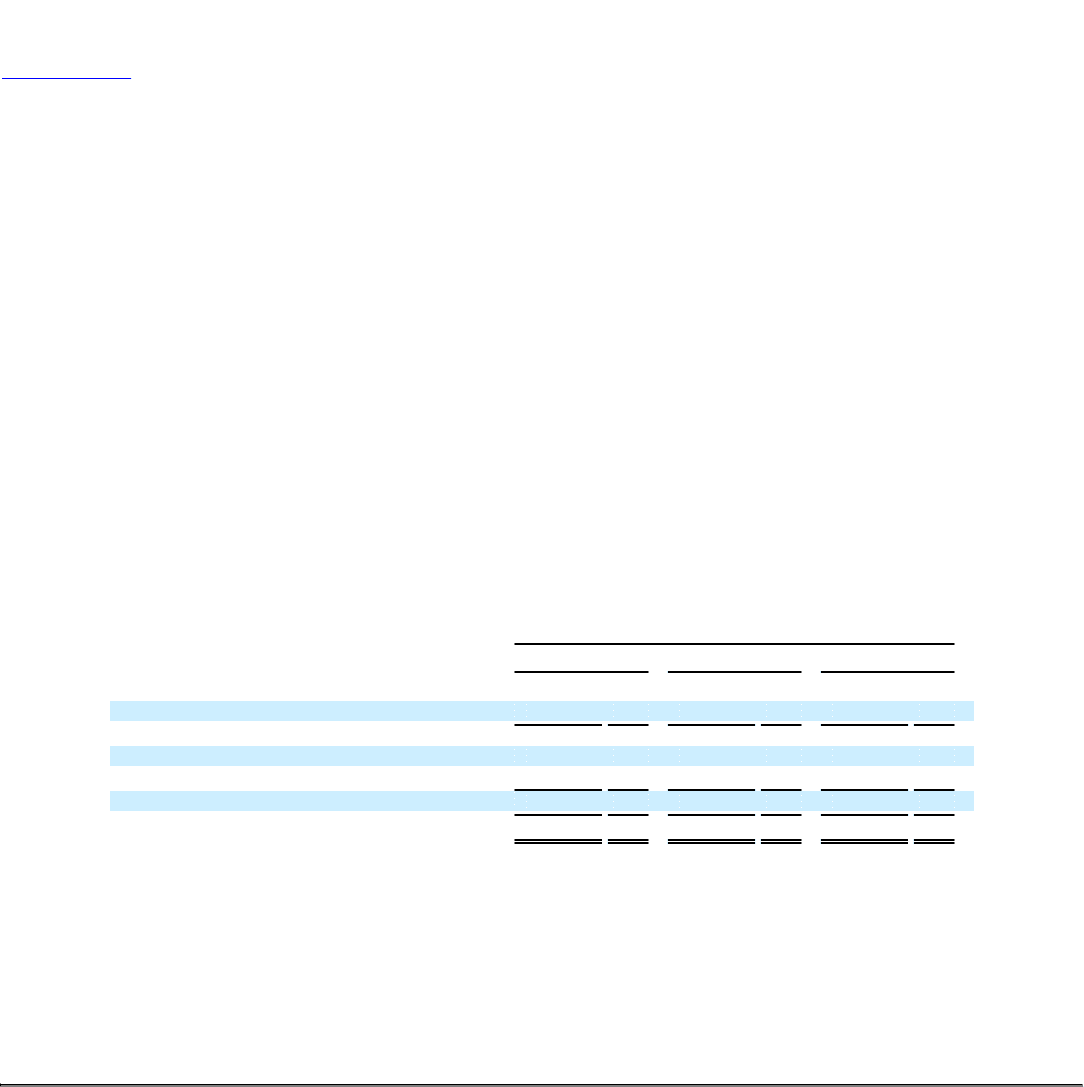

Cost of goods sold

Cost of goods sold includes product costs, warehousing costs, outbound shipping costs, handling and fulfillment costs, customer service costs and credit

card fees, and is recorded in the same period in which related revenues have been recorded. Fulfillment costs include warehouse handling labor costs, fixed

warehouse costs, credit card fees and customer service costs. Cost of goods sold, including product cost and other costs and fulfillment costs are as follows (in

thousands):

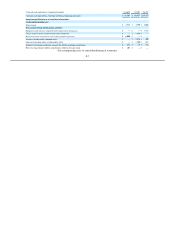

Year ended December 31,

2007 2008 2009

(Restated)

Total net revenue $ 765,902 100% $ 829,850 100% $ 876,769 100%

Cost of goods sold

Product costs and other cost of goods sold 594,276 78% 638,368 77% 664,537 76%

Fulfillment costs 47,076 6% 47,246 6% 47,480 5%

Total cost of goods sold 641,352 84% 685,614 83% 712,017 81%

Gross profit $ 124,550 16% $ 144,236 17% $ 164,752 19%

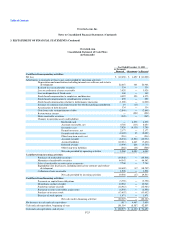

Advertising expense

The Company expenses the costs of producing advertisements the first time the advertising takes place and expenses the cost of communicating

advertising in the period during which the advertising space or airtime is used. Internet advertising expenses are recognized as incurred based on the terms of

the individual agreements, which are generally: 1) a commission for traffic driven to the Website that generates a sale or 2) a referral fee based on the number

of clicks on keywords or links to the Company's Website generated during a given period. Advertising expense is included in sales and marketing expenses

and totaled $51.0 million, $52.8 million and $48.9 million during the years ended December 31, 2007, 2008 and 2009, respectively. Prepaid advertising,

which consist primarily of prepaid advertising airtime, (included in Prepaids and other assets in the accompanying Consolidated Balance Sheets) was

$877,000 and $1.6 million at December 31, 2008 and 2009, respectively.

F-17