Overstock.com 2009 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

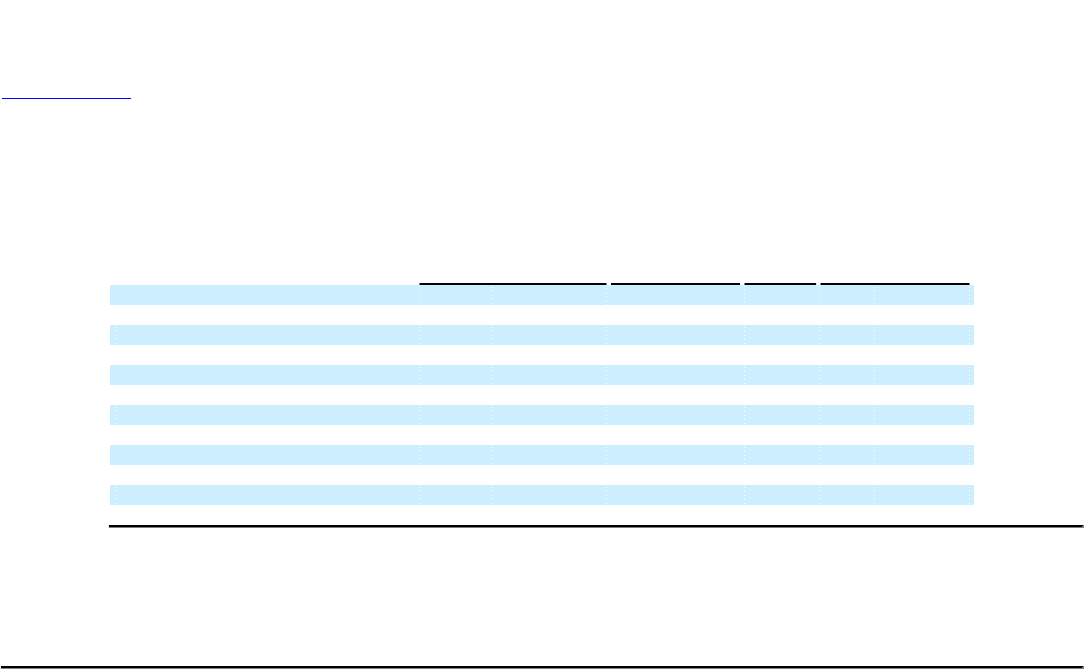

Table of Contents

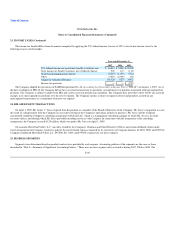

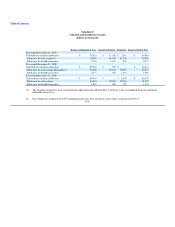

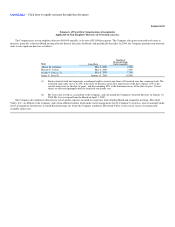

Schedule II

Valuation and Qualifying Accounts

(dollars in thousands)

Balance at Beginning of Year Charged to Expense Deductions Balance at End of Year

Year ended December 31, 2007

Deferred tax valuation allowance $ 76,431 $ 11,526 $ 2,041 $ 85,916

Allowance for sales returns(2) 16,929 68,933 61,536 24,326

Allowance for doubtful accounts 2,135 1,197 855 2,477

Year ended December 31, 2008

Deferred tax valuation allowance $ 85,916 $ 527 $ — $ 86,443

Allowance for sales returns (Restated)(1) 24,326 66,522 74,615 16,233

Allowance for doubtful accounts 2,477 550 1,433 1,594

Year ended December 31, 2009

Deferred tax valuation allowance $ 86,443 $ — $ 6,198 $ 80,245

Allowance for sales returns 16,233 70,994 75,304 11,923

Allowance for doubtful accounts 1,594 265 129 1,730

The amounts herein have been restated for the adjustments described in Note 3 of Notes to the consolidated financial statements

included in Item 15(a).

For comparative purposes the 2007 beginning balance has been shown on a gross basis as disclosed in Note 3.

(1)

(2) F-55