Overstock.com 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Allowance for doubtful accounts

From time to time, we grant credit to certain of our business customers on normal credit terms (typically 30 days). We perform credit evaluations of our

customers' financial condition and payment history and maintain an allowance for doubtful accounts receivable based upon our historical collection

experience and expected collectability of all accounts receivable. The allowance for doubtful accounts receivable was $1.6 million and $1.7 million at

December 31, 2008 and 2009, respectively.

Valuation of inventories

We write down our inventory for estimated obsolescence and to lower of cost or market value based upon assumptions about future demand and market

conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required. Once

established, the original cost of the inventory less the related inventory allowance represents the new cost basis of such products. Reversal of the allowance is

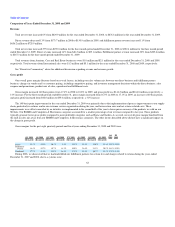

recognized only when the related inventory has been sold or scrapped. At December 31, 2008, our inventory balance was $24.7 million (including

$9.8 million of inventory in-transit related to sales shipped but not yet delivered), net of allowance for obsolescence or damaged inventory of $2.1 million. At

December 31, 2009, our inventory balance was $23.4 million (including $8.0 million of inventory in-transit), net of allowance for obsolescence or damaged

inventory of $2.2 million.

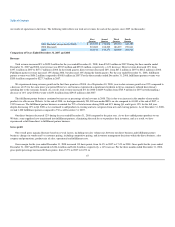

Internal-use software and website development

Included in fixed assets is the capitalized cost of internal-use software and website development, including software used to upgrade and enhance our

Website and processes supporting our business. We capitalize costs incurred during the application development stage of internal-use software and amortize

these costs over the estimated useful life of two to three years. Costs incurred related to design or maintenance of internal-use software are expensed as

incurred.

During the year ended December 31, 2008 and 2009, we capitalized $9.0 million and $5.4 million, respectively, of costs associated with internal-use

software and website development, both developed internally and acquired externally, in each period. Amortization of costs associated with internal-use

software and website development was $11.6 million and $6.0 million for those respective periods. The decrease in costs associated with internal-use software

and website development is primarily related to the greater number of software licenses purchased in 2008 compared to 2009.

Accounting for income taxes

Significant management judgment is required in determining our provision for income taxes, our deferred tax assets and liabilities and any valuation

allowance recorded against our deferred tax assets. As of December 31, 2008 and 2009, we have recorded a full valuation allowance of $86.4 million and

$80.2 million, respectively, against our net deferred tax asset balance due to uncertainties related to our deferred tax assets as a result of our history of

operating losses. The valuation allowance is based on our estimates of taxable income by jurisdiction in which we operate and the period over which our

deferred tax assets will be recoverable. In the event that actual results differ from these estimates or we adjust these estimates in future periods, we may need

to change the valuation allowance, which could materially impact our financial position and results of operations.

We are subject to audit by the IRS and various states for periods since inception. Our policy is that we recognize interest and penalties accrued on any

unrecognized tax positions as a component of income tax expense. We do not have any material uncertain tax positions, accrued interest or penalties

associated with unrecognized tax positions. There have been no material changes relating to these matters during the year ended December 31, 2009.

58