Overstock.com 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

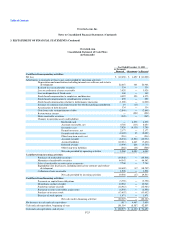

15. BORROWINGS (Continued)

"Stock and Debt Repurchase Program"). As of December 31, 2009, a face amount of $60.0 million of the Senior Notes remain outstanding with a carrying

amount of $59.5 million and $528,000 of debt discount.

In May 2008, the FASB issued ASC Topic 470-20, Debt with Conversion and Other Options ("ASC 470-20"), which clarifies the accounting for

convertible debt instruments that may be settled in cash upon conversion, including partial cash settlement. ASC 470-20 specifies that an issuer of such

instruments should separately account for the liability and equity components of the instruments in a manner that reflect the issuer's non-convertible debt

borrowing rate when interest costs are recognized in subsequent periods. ASC 470-20 is effective for financial statements issued for fiscal years beginning

after December 15, 2008 and interim periods within those fiscal years. The adoption of ASC 470-20 did not have a material impact on the consolidated

financial statements.

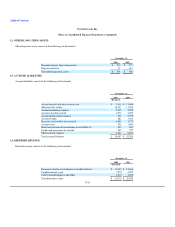

Capital leases

The Company leased certain software and computer equipment during the year ended December 31, 2009, under non-cancelable leases that expire on

various dates through 2012.

Software and equipment acquired under capital leases totaled $19.8 million and $1.7 million, with accumulated amortization of $19.3 million and

$335,000 at December 31, 2008 and 2009. Depreciation expense for assets recorded under capital leases was $3.9 million and $335,000 for the years ended

December 31, 2008 and 2009, respectively.

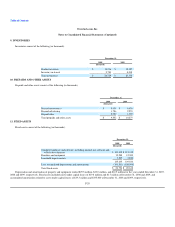

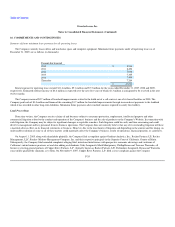

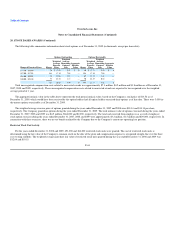

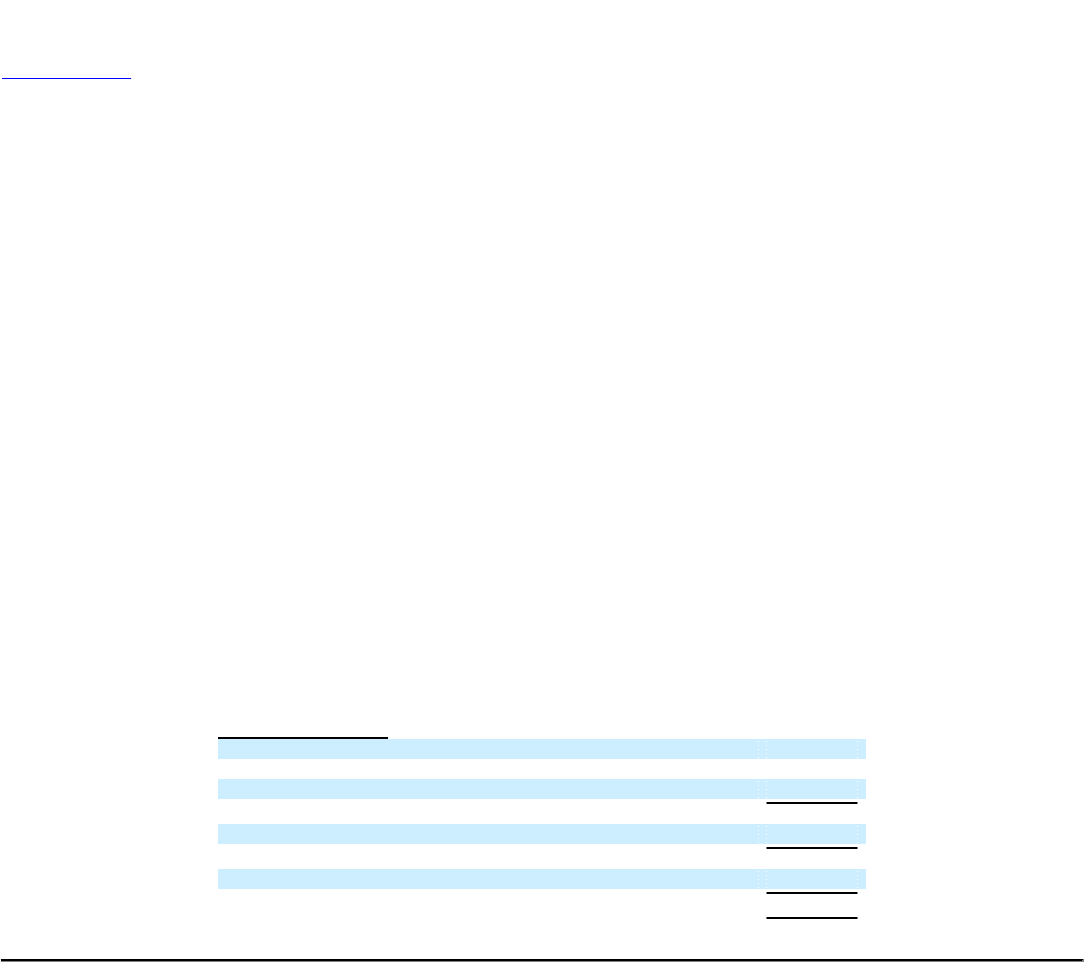

Future payments of capital lease obligations are as follows (in thousands):

Payments due by period

2010 $ 646

2011 793

2012 116

Total minimum lease payments 1,555

Less: amount representing interest 229

Present value of capital lease obligations 1,326

Less: current portion 520

Capital lease obligations, non-current $ 806

F-34