Overstock.com 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Change in our accounting for external audit fees to the "as incurred" method instead of the "ratable" method.

Other miscellaneous adjustments, none of which were material either individually or in the aggregate. Certain of these adjustments were related

to a reduction in revenue and cost of goods sold in equal amounts for certain consideration we received from vendors, an increase in inventory,

accounts payable and accrued liabilities to record our sales return allowance on a gross basis, an adjustment to our cash and restricted cash

balances due to compensating balance arrangements and an adjustment to record redeemable common stock for certain shares previously issued

to employees.

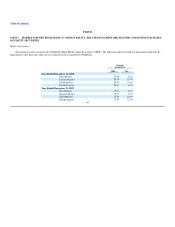

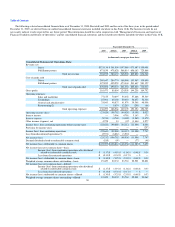

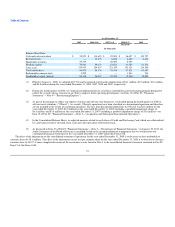

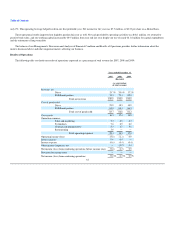

The effect of the adjustments on the consolidated statement of operations as of and for the year ended December 31, 2008 is to decrease net loss

attributable to common shares by $1.6 million. All amounts in Management's Discussion and Analysis of Financial Condition and Results of Operations for

the year ended December 31, 2008 have been adjusted, as appropriate, for the effects of the restatement.

A more complete discussion of the restatement can be found in Note 3 to the consolidated financial statements contained in Part IV, Item 15 of this

Form 10-K.

Overview

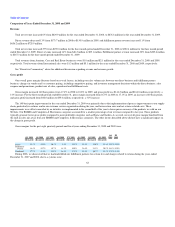

We are an online retailer offering closeout and discount brand and non-brand name merchandise, including bed-and-bath goods, home décor,

kitchenware, watches, jewelry, electronics and computers, sporting goods, apparel, and designer accessories, among other products. We also sell books,

magazines, CDs, DVDs and video games ("BMMG"). We also operate as part of our Website an online auctions business—a marketplace for the buying and

selling of goods and services—as well as online sites for listing cars and real estate for sale. We also recently launched O.biz, a website where customers can

shop for bulk and business related items.

We offer approximately 168,000 products under multiple departments under the shopping tab on our Website, and offer approximately 661,000 media

products in the Books etc. department on our Website. We have organized our shopping business (sales of product offered through the Shopping section of

our Website) into two principal segments—a "direct" business and a "fulfillment partner" business (see Item 15 of Part IV, "Financial Statements"—Note 25

—"Business Segments"). We include revenue from our auctions, car listings, real estate and consignment operations in the fulfillment partner segment.

Revenue generated from our O.biz website and our international sales is included in either direct or fulfillment partner revenue, depending on whether the

product is shipped from our warehouses or from a fulfillment partner. Less than 1% of our sales are made indirectly to international customers. During the

years ended December 31, 2007, 2008, and 2009, no single customer accounted for more than 1% of our total revenue.

Direct business

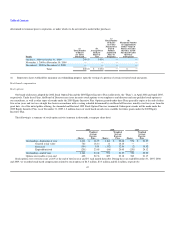

Our direct business includes sales made to individual consumers and businesses, which are fulfilled from our leased warehouses in Salt Lake City, Utah.

During the years ended December 31, 2008 and 2009, we fulfilled approximately 15% of our order volume through our warehouses. Our warehouses

generally ship between 7,000 and 10,000 orders per day and up to approximately 32,000 orders per day during peak periods, using overlapping daily shifts.

Fulfillment partner business

For our fulfillment partner business, we sell merchandise of other retailers, cataloguers or manufacturers ("fulfillment partners") through our Website.

We are considered to be the primary

53

•

•