Overstock.com 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

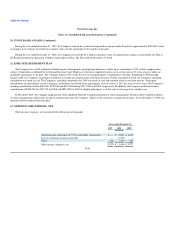

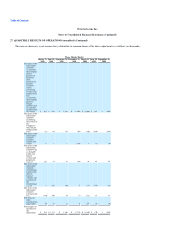

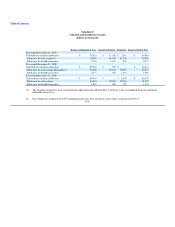

23. INCOME TAXES (Continued)

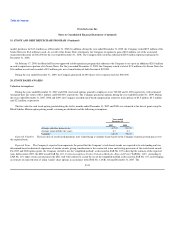

The income tax benefit differs from the amount computed by applying the U.S. federal income tax rate of 35% to loss before income taxes for the

following reasons (in thousands):

Year ended December 31,

2007 2008 2009

U.S. federal income tax (provision) benefit at statutory rate $ 16,813 $ 3,880 $ (2,762)

State income tax benefit (expense), net of federal expense 949 147 (112)

Stock based compensation expense (2,267) (1,491) (781)

Other (3,969) (2,009) (64)

Change in valuation allowance (11,526) (527) 3,462

Income tax provision $ — $ — $ (257)

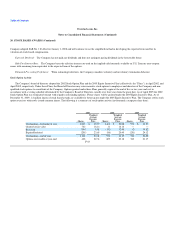

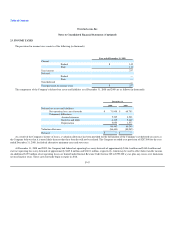

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes ("FIN 48") on January 1, 2007. As of

the date of adoption of FIN 48, the Company did not have any material uncertain tax positions, accrued interest or penalties associated with unrecognized tax

positions. The Company is subject to audit by the IRS and various states for periods since inception. The Company does not believe there will be any material

changes in its unrecognized tax positions over the next 12 months. The Company's policy is that it recognizes interest and penalties accrued on any

unrecognized tax positions as a component of income tax expense.

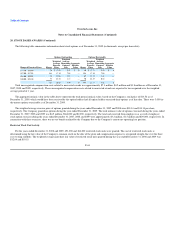

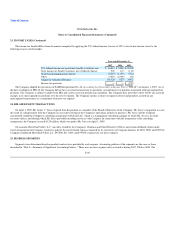

24. RELATED PARTY TRANSACTIONS

On April 1, 2009, Mr. James V. Joyce resigned from his position as a member of the Board of Directors of the Company. Mr. Joyce's resignation was not

the result of a disagreement with the Company on any matter relating to the Company's operations, policies or practices. Mr. Joyce and the Company

concurrently ended the Company's consulting arrangement with Icent LLC, which is a management consulting company of which Mr. Joyce is the chief

executive officer, and through which Mr. Joyce provided consulting services to the Company. In connection with the termination of the consulting

arrangement, the Company accrued $1.25 million, which was paid to Mr. Joyce on April 1, 2009.

On occasion, Haverford-Valley, L.C. (an entity owned by the Company's Chairman and Chief Executive Officer) and certain affiliated entities make

travel arrangements for Company executives and pay the travel related expenses incurred by its executives on Company business. In 2007, 2008, and 2009 the

Company reimbursed Haverford-Valley L.C. $93,000, $111,000, and $79,000, respectively, for these expenses.

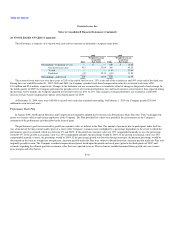

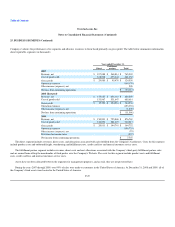

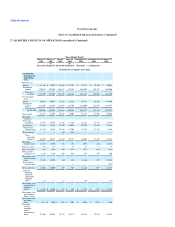

25. BUSINESS SEGMENTS

Segments were determined based on products and services provided by each segment. Accounting policies of the segments are the same as those

described in "Note 2—Summary of Significant Accounting Policies." There were no inter-segment sales or transfers during 2007, 2008 or 2009. The

F-48