Overstock.com 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

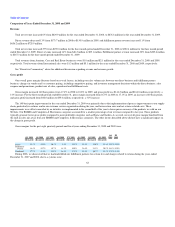

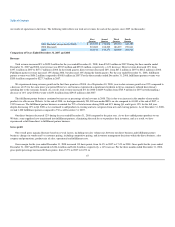

Of the total $5.5 million underbilling, $2.8 million related to the year ended December 31, 2007 and $2.7 million related to the year ended December 31,

2008.

We contacted the affected fulfillment partners and in our negotiations with them over several months, we agreed to forgive the $2.8 million related to the

2007 amounts and to seek to recover the $2.7 million related to 2008 over time from our future sales of the fulfillment partners' products during the remainder

of 2008 and 2009. As a result of the negotiations we later agreed to forgive an additional $375,000. We recovered a total of $2.3 million through

December 31, 2009, including $1.8 million during the three months ended December 31, 2008 and $615,000 during the year ended December 31, 2009. We

have recorded the amounts recovered related to 2008 in the period that they originated. See Note 3 of the consolidated financial statements (see Item 15 of

Part IV, "Financial Statements"—Note 3—"Restatement of Financial Statements") for additional information.

During our review of our partner billing system for returns, we additionally discovered that we had underbilled our fulfillment partners for certain fees

and charges related to returns during the fourth quarter of 2008 and the year ended December 31, 2009 totaling approximately $187,000 and $1.2 million,

respectively. We have made the determination to not seek recovery of these amounts from our fulfillment partners and consequently have not recognized any

related recoveries in our consolidated financial statements.

Cost of goods sold includes stock-based compensation expense of $198,000 and $167,000 for the years ended December 31, 2008 and 2009,

respectively.

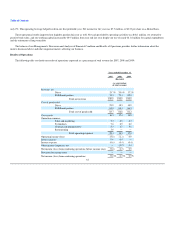

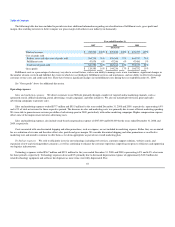

Direct Gross Profit—Gross profit for our direct business increased 2% from $19.7 million for the year ended December 31, 2008 to $20.0 million for the

same period in 2009, and gross margin increased from 11.4% to 13.3%. For the three month periods ended December 31, gross profit increased 53% from

$4.3 million in 2008 to $6.6 million in 2009, and gross margin increased from 8.8% to 11.9%.

Fulfillment Partner Gross Profit—Our fulfillment partner business generated gross profit of $124.5 million and $144.7 million for the years ended

December 31, 2008 and 2009, respectively, an increase of 16%, and gross margin increased from 19.0% to 19.9%. For the three month periods ended

December 31, gross profit increased 29% from $37.7 million in 2008 to gross profit of $48.5 million in 2009, and gross margin decreased from 18.3% to

18.1%

See "Executive Commentary" above for additional discussion.

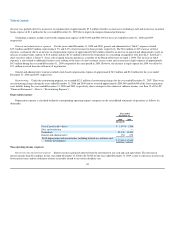

Fulfillment costs

Fulfillment costs include all warehousing costs, including fixed overhead and variable handling costs (excluding packaging costs), as well as credit card

fees and customer service costs, all of which we include as costs in calculating gross margin. We believe that some companies in our industry, including some

of our competitors, account for fulfillment costs within operating expenses, and therefore exclude fulfillment costs from gross margin. As a result, our gross

margin may not be directly comparable to others in our industry.

63