Overstock.com 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact, including statements regarding guidance, industry prospects or future results of operations or financial

position, made in this Annual Report on Form 10-K are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar

expressions to identify forward-looking statements. Forward-looking statements reflect management's current expectations and are inherently uncertain.

Actual results could differ materially for a variety of reasons, including, among others, changes in global economic conditions and consumer spending, world

events, the rate of growth of the Internet and online commerce, the amount that we invest in new business opportunities and the timing of those investments,

the mix of products sold to customers, the mix of net sales derived from products as compared with services, the extent to which we owe income and other

taxes, competition, management of growth, potential fluctuations in operating results, international growth and expansion, fluctuations in foreign exchange

rates, the outcomes of legal proceedings and claims, fulfillment center optimization, risks of inventory management, seasonality, the degree to which we enter

into, maintain, and develop commercial agreements, acquisitions, and strategic transactions, payments risks, and risks of fulfillment throughput and

productivity. In addition, the recent global economic climate amplifies many of these risks. These risks and uncertainties, as well as other risks and

uncertainties that could cause our actual results to differ significantly from management's expectations, are described in greater detail in Item 1A of Part I,

"Risk Factors."

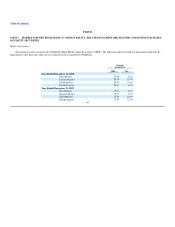

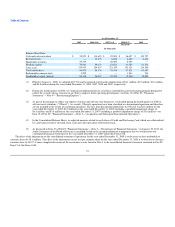

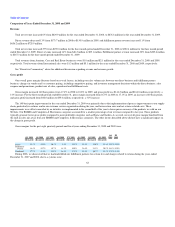

Restatement

On January 29, 2010, the Audit Committee of the Board of Directors concluded, based on the recommendation of management, that we would restate

(1) our consolidated financial statements for the year ended December 31, 2008 and (2) our quarterly consolidated financial statements for all interim periods

for the year ended December 31, 2008 and the interim periods ended March 31, 2009, June 30, 2009 and September 30, 2009 within this Form 10-K to correct

the following errors:

Accounting for amounts that we pay our drop ship fulfillment partners and an amount due from a vendor that went undiscovered for a period of

time. Specifically, these errors related to (1) amounts we paid to partners or deducted from partner payments related to return processing services

and product costs and (2) amounts we paid to a freight vendor based on incorrect invoices from the vendor. Once discovered, we applied "gain

contingency" accounting for the recovery of such amounts, which was an inappropriate accounting treatment.

Amortization of the expense related to restricted stock units. Previously the expense was based on the actual three year vesting schedule, which

incorrectly understated the expense as compared to a three year straight line amortization. We also corrected for the use of an outdated forfeiture

rate in calculating share-based compensation expense under the plans.

The following additional adjustments were also included in this restatement:

Correction of certain amounts related to customer refunds and credits.

Recognition of co-branded credit card bounty revenue and promotion expense over the estimated term of the credit card relationships. Previously

the revenue was incorrectly recognized when the card was issued.

Reduction in the restructuring accrual and correction of the related expense due to a 2008 sublease benefit which was previously excluded from

the accrual calculation and the accretion of interest expense related to the restructuring accrual, which was not previously recorded.

52

•

•

•

•

•