Overstock.com 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

16. COMMITMENTS AND CONTINGENCIES (Continued)

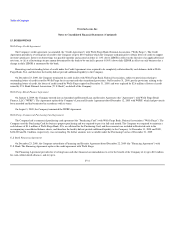

On August 12, 2008, the Company along with seven other defendants, was sued in the United States District Court for the Northern District of

California, by Sean Lane, and seventeen other individuals, on their own behalf and for others similarly in a class action suit, alleging violations of the

Electronic Communications Privacy Act, Computer Fraud and Abuse Act, Video Privacy Protection Act, and California's Consumer legal Remedies Act and

Computer Crime Law. The complaint relates to the Company's use of a product known as Facebook Beacon, created and provided to the Company by

Facebook, Inc. Facebook Beacon provided the means for Facebook users to share purchasing data among their Facebook friends. The parties extended by

agreement the time for defendants' answer, including the Company's answer, and thereafter, the Plaintiff and Facebook proposed a stipulated settlement to the

court for approval, which would resolve the case without requirement of financial contribution from the Company. Some parties lodged objections, but the

court has accepted the proposed settlement. Unless appealed, we expect the court's acceptance and the administrative details of settlement to be finalized in

the coming months. The nature of the loss contingencies relating to claims that have been asserted against us are described above. However no estimate of the

loss or range of loss can be made.

On November 14, 2008, the Company filed suit in Ohio state court against the Ohio Tax Commissioner, the Ohio Attorney General and the Governor of

Ohio, alleging the Ohio Commercial Activity Tax is unconstitutional. Enacted in 2005, Ohio's Commercial Activity Tax is based on activities in Ohio that

contribute to production or gross income for a company whether or not the company has a physical presence in or nexus within the state. The Company's

complaint asked for a judgment declaring the tax unconstitutional and for an injunction preventing any enforcement of the tax. The defendants moved to

dismiss the case. On July 28, 2009, the trial court ruled that there was no justiciable controversy in the case, as the Company had not yet been assessed a tax,

and it granted the defendants' motions to dismiss. The Company has since received a letter of determination from the Ohio Department of Taxation noting the

Department's determination that the Company is required to register for remitting of the Commercial Activity Tax, and owes $612,784 in taxes, interest, and

penalties. The Company believes the determinations to be wrong and will vigorously contest the determinations.

On March 10, 2009, the Company was sued in a class action filed in the United States District Court, Eastern District of New York. Cynthia Hines is the

nominative plaintiff. Ms. Hines alleges the Company failed to properly disclose its returns policy to her and that it improperly imposed a "restocking" charge

on her return of a vacuum cleaner. The nominative plaintiff on behalf of herself and others similarly situated, seeks damages under claims for breach of

contract, common law fraud and New York consumer fraud laws. The Company filed a motion to dismiss based upon assertions that the Company's

agreement with its customers requires all such actions to be arbitrated in Salt Lake City, Utah. Alternatively, the Company asked that the case be transferred

to the United States District Court for the District of Utah, so that arbitration may be compelled in that district. On September 8, 2009 the motion to dismiss

was denied, the court stating that the Company's browsewrap agreement was insufficient under New York law to establish an agreement with the customer to

arbitrate disputes in Utah. On October 8, 2009, the Company filed a Notice of Appeal of the court's ruling and the appeal is in the briefing stage. The nature of

the loss contingencies relating to claims that have been asserted against us are described above. However no estimate of the loss or range of loss can be made.

The suit is in its early stages, and the Company intends to vigorously defend this action.

F-38