Logitech 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

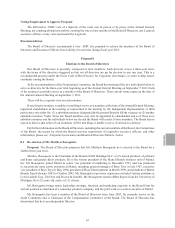

64

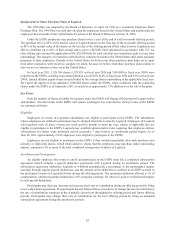

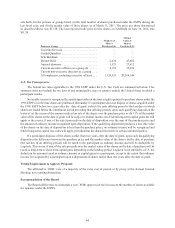

sets forth, for the persons or groups listed, (a) the total number of shares purchased under the ESPPs during the

last fiscal year, and (b) the market value of these shares as of March 31, 2011. The price per share determined

as described above was $13.38. The last reported trade price for the shares on NASDAQ on June 30, 2011, was

$11.24.

Person or Group

Number of

Shares

Purchased (#)

Market

Value of

Shares

Purchased ($)

Guerrino De Luca ....................... — —

Gerald Quindlen ........................ — —

Erik Bardman .......................... — —

Werner Heid ............................ 2,630 47,682

Junien Labrousse ........................ 1,523 27,612

Current executive officers as a group (6) . . . . . 4,153 75,294

Current non-executive directors as a group . . . — —

All employees, excluding executive officers ... 1,124,553 20,388,146

U.S. Tax Consequences

The federal tax rules applicable to the 1996 ESPP under the U.S. Tax Code are summarized below. This

summary does not include the tax laws of any municipality, state or country outside the United States in which a

participant resides.

No taxable income is recognized by a participant either at the time a right is granted to purchase shares under the

1996 ESPP or at the time shares are purchased thereunder. If a participant does not dispose of shares acquired under

the 1996 ESPP before two years after the “date of grant” (which for each offering period is the last day on which

shares are traded before the enrollment period preceding that offering period), upon such qualifying disposition the

lesser of (a) the excess of the amount realized on sale of the shares over the purchase price or (b) 15% of the market

value of the shares on the date of grant will be subject to federal income tax. Federal long-term capital gains tax will

apply to the excess, if any, of the sale’s proceeds on the date of disposition over the sum of the purchase price and

the amount of ordinary income recognized upon disposition. If the qualifying disposition produces a loss (the value

of the shares on the date of disposition is less than the purchase price), no ordinary income will be recognized and

federal long-term capital loss rules will apply, provided that the disposition involves certain unrelated parties.

If a participant disposes of the shares earlier than two years after the date of grant, upon such disqualifying

disposition the difference between the purchase price and the market value of the shares on the date of purchase

(the last day of an offering period) will be taxed to the participant as ordinary income and will be deductible by

Logitech. The excess, if any, of the sale proceeds over the market value of the shares on the date of purchase will be

taxed as long-term or short-term capital gain, depending on the holding period. Logitech is not entitled to a U.S. tax

deduction for amounts taxed as ordinary income or capital gains to a participant, except to the extent that ordinary

income is recognized by a participant upon a disposition of shares earlier than two years after the date of grant.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General

Meeting, not counting abstentions.

Recommendation of the Board

The Board of Directors recommends a vote “FOR” approval of the increase to the number of shares available

for issuance under the ESPPs.