Logitech 2011 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

221

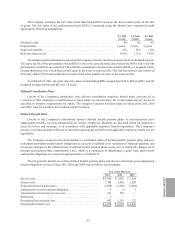

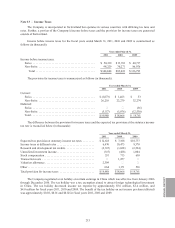

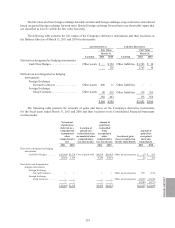

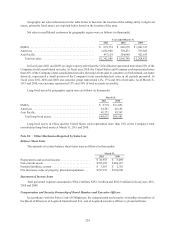

Purchase Commitments

At March 31, 2011, the Company had the following outstanding purchase commitments:

March 31, 2011

Inventory purchases ..................................... $165,286

Operating expenses ..................................... 49,839

Capital expenditures ..................................... 10,724

Total purchase commitments ........................ $225,849

Commitments for inventory purchases are made in the normal course of business to original design

manufacturers, contract manufacturers and other suppliers and are expected to be fulfilled by September 2011.

Operating expense commitments are for consulting services, marketing arrangements, advertising, outsourced

customer services and other services. Fixed purchase commitments for capital expenditures primarily related to

commitments for manufacturing equipment and tooling. Although open purchase orders are considered enforceable

and legally binding, the terms generally allow the Company the option to reschedule and adjust its requirements

based on the business needs prior to delivery of goods or performance of services.

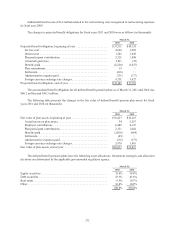

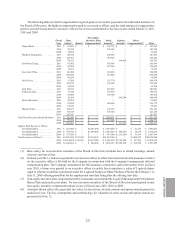

Guarantees

The Company has guaranteed the purchase obligations of some of its contract manufacturers and original

design manufacturers to certain component suppliers. These guarantees generally have a term of one year and are

automatically extended for one or more years as long as a liability exists. The amount of the purchase obligations

of these manufacturers varies over time, and therefore the amounts subject to Logitech’s guarantees similarly vary.

At March 31, 2011, there were no outstanding guaranteed purchase obligations. The maximum potential future

payments under two of the three guarantee arrangements is limited to $30.0 million. The third guarantee is limited

to purchases of specified components from the named suppliers. The Company does not believe, based on historical

experience and information currently available, that it is probable that any amounts will be required to be paid

under these guarantee arrangements.

Logitech International S.A., the parent holding company, has guaranteed certain contingent liabilities of

various subsidiaries related to specific transactions occurring in the normal course of business. The maximum

amount of the guarantees was $54.7 million as of March 31, 2011. As of March 31, 2011, $10.3 million was

outstanding under these guarantees. The parent holding company has also guaranteed the purchases of one

of its subsidiaries under three guarantee agreements. Two of these guarantees do not specify a maximum

amount. The third guarantee is limited to $7.0 million. As of March 31, 2011, $4.9 million was outstanding under

these guarantees.

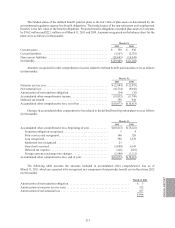

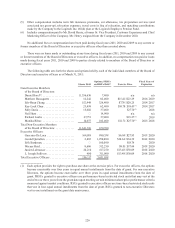

Indemnifications

Logitech indemnifies some of its suppliers and customers for losses arising from matters such as intellectual

property rights and product safety defects, subject to certain restrictions. The scope of these indemnities varies, but

in some instances, includes indemnification for damages and expenses, including reasonable attorneys’ fees. No

amounts have been accrued for indemnification provisions at March 31, 2011. The Company does not believe, based

on historical experience and information currently available, that it is probable that any amounts will be required

to be paid under its indemnification arrangements.

Letters of Credit

Logitech provides various third parties with irrevocable letters of credit in the normal course of business to

secure its obligations to pay or perform pursuant to the requirements of an underlying agreement or the provision

of goods and services. These standby letters of credit are cancelable only at the option of the beneficiary who is

authorized to draw drafts on the issuing bank up to the face amount of the standby letter of credit in accordance

with its terms. At March 31, 2011, the Company had $0.7 million of letters of credit in place, of which $0.1 million

was outstanding. These letters of credit relate primarily to equipment purchases by a subsidiary in China, and

expire between April and December 2011.