Logitech 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

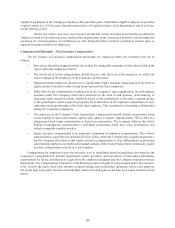

Grants to Mr. Quindlen. On November 15, 2010 during the annual stock focal cycle, Mr. Quindlen received a

PSU grant for 141,000 shares, assuming 100% target performance, and an RSU grant of 94,000 shares, as part of his

fiscal year 2011 annual compensation as CEO. In the analysis provided by the Committee’s independent compensation

consultant, it was noted that Mr. Quindlen’s fiscal year 2010 equity grants and his equity value as a percentage of market

capitalization were significantly below the 25th percentile for CEOs in our peer group. Their resulting recommendation

was to provide a fiscal year 2011 equity grant with value at least median for CEOs in our peer group to begin to

improve Mr. Quindlen’s position relative to the CEOs of our benchmark peer companies. The total number of shares

granted to Mr. Quindlen was based upon the mix of compensation components, the recommendation provided by

the independent consultant, the Compensation Committee’s consideration of the accrued value of past grants to

Mr. Quindlen, as well as the Compensation Committee’s estimate of Mr. Quindlen’s potential for future contributions

to Logitech’s success. Mr. Quindlen’s fiscal year 2011 equity grants were above the median value for our peer

group; however his total equity value as a percentage of market capitalization remained below market median for

our peer group.

Grant to Mr. De Luca. On November 15, 2010 during the annual stock focal cycle, Mr. De Luca received a

PSU grant for 30,000 shares, assuming 100% target performance, as part of his fiscal year 2011 compensation as

Chairman. Mr. De Luca did not receive any other equity incentive grants during fiscal year 2011.

Grants to Other Named Executive Officers. The equity incentive award grants made to all Logitech named

executive officers during fiscal year 2011 are set out in the Grants of Plan-Based Awards in Fiscal Year 2011 table

below. The value of long-term equity incentive awards in the form of PSUs and RSUs granted during fiscal year

2011 was in aggregate below the peer group, based on March 2010 compensation review data produced by the

Committee’s independent compensation consultant.

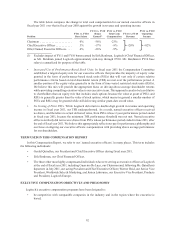

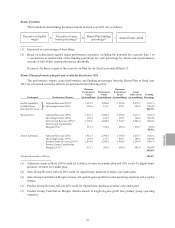

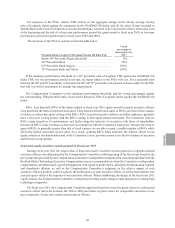

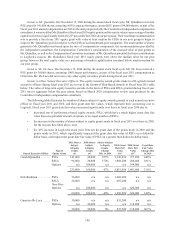

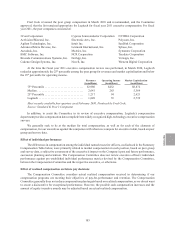

The following table illustrates the number of shares subject to equity awards granted to each named executive

officer in fiscal year 2011 and 2010, and their grant date fair values, which represent their accounting cost to

Logitech. Fiscal year 2011 grant date fair values increased significantly over those in fiscal year 2010 due to:

• increased use of performance-based equity awards, PSUs, which have a much higher grant date fair

value than an equivalent amount of options or an equal number of RSUs,

• the increase in the number of shares subject to equity grants made in fiscal year 2011 over those in 2010,

for the reasons described above, and

• the 45% increase in Logitech’s stock price between the grant date of the grants made in 2010 and the

grants made in 2011, which significantly impacted the grant date fair value of RSUs on a dollar-for-

dollar basis, and impacts the grant date fair value of PSUs on a greater than dollar-for-dollar basis.

Named Executive Officer Type of

Equity Grant

2011 Shares

Subject

to Equity

Grants

(#)

2010 Shares

Subject

to Equity

Grants

(#)

Shares Subject

to Equity

Grants -

Change

2011 to 2010

2011 Grant

Date Fair

Value

($)(1)

2010 Grant

Date Fair

Value

($)(1)

Grant Date

Fair Value

Change 2011

to 2010

Gerald Quindlen ....... PSUs 141,000 40,000 253% 3,926,850 727,200 440%

RSUs 94,000 20,000 370% 1,908,200 280,400 581%

Options n/a 100,000 n/a n/a 394,000 n/a

235,000 160,000 47% 5,835,050 1,401,600 316%

Erik Bardman ......... PSUs 36,000 n/a n/a 1,002,600 n/a n/a

RSUs 24,000 n/a n/a 487,200 n/a n/a

New Hire

Options n/a 100,000 n/a n/a 620,000 n/a

60,000 100,000 -40% 1,489,800 620,000 140%

Guerrino De Luca ...... PSUs 30,000 n/a n/a 835,500 n/a n/a

Options n/a 30,000 n/a n/a 118,200 n/a

30,000 30,000 0% 835,500 118,200 607%