Logitech 2011 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

195

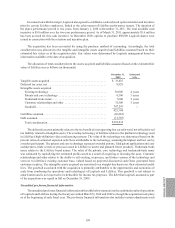

Derivative Financial Instruments

The Company enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables and to hedge against exposure to changes

in foreign currency exchange rates related to its subsidiaries’ forecasted inventory purchases. These forward

contracts generally mature within one to three months. The Company may also enter into foreign exchange swap

contracts to extend the terms of its foreign exchange forward contracts.

Gains and losses in the fair value of the effective portion of our forward contracts related to forecasted

inventory purchases are deferred as a component of accumulated other comprehensive loss until the hedged

inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. Gains or

losses in fair value on forward contracts which offset translation losses or gains on foreign currency receivables or

payables are recognized in earnings monthly and are included in other income (expense), net.

Recent Accounting Pronouncements

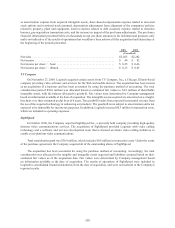

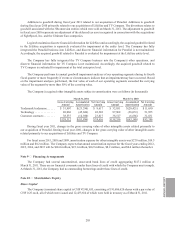

In December 2010, the FASB (Financial Accounting Standards Board) issued ASU 2010-28, Intangibles —

Goodwill and Other (Topic 350): When to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with

Zero or Negative Carrying Amounts. For reporting units with zero or negative carrying amounts, if it is more likely

than not that a goodwill impairment exists, ASU 2010-28 requires performance of an additional test to determine

whether goodwill has been impaired and to calculate the amount of impairment. In determining whether it is

more likely than not that a goodwill impairment exists, an entity should consider whether there are any adverse

qualitative factors indicating that an impairment may exist. ASU 2010-28 is effective for fiscal years and interim

periods within those years beginning after December 15, 2010. Logitech will adopt ASU 2009-28 in the first

quarter of fiscal year 2012. The impact of adopting ASU 2010-28 will not be known until the Company performs

its evaluations of goodwill impairment.

In December 2010, the FASB issued ASU 2010-29, Business Combinations (Topic 805): Disclosure of

Supplementary Pro Forma Information for Business Combinations. ASU 2010-29 specifies that, for material business

combinations when comparative financial statements are presented, revenue and earnings of the combined entity

should be disclosed as though the business combination had occurred as of the beginning of the comparable prior

annual reporting period. ASU 2010-09 also expands the supplemental pro forma disclosures to include a description

of the nature and amount of material, nonrecurring pro forma adjustments directly attributable to the business

combination included in the reported pro forma revenue and earnings. ASU 2010-09 is effective prospectively for

business combinations with an acquisition date on or after the beginning of the first annual reporting period after

December 15, 2010. We will adopt this guidance for acquisitions beginning in fiscal year 2012.

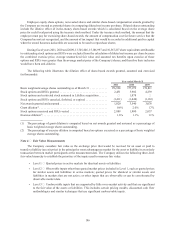

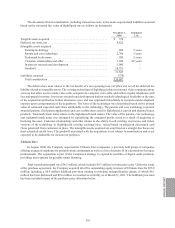

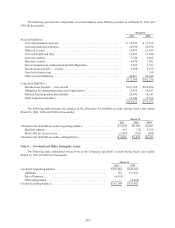

Note 3 — Net Income per Share

The computations of basic and diluted net income per share for the Company were as follows (in thousands

except per share amounts):

Year ended March 31,

2011 2010 2009

Net income — basic and diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $128,460 $64,957 $107,032

Weighted average shares — basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 176,928 177,279 178,811

Effect of dilutive stock options .................................... 1,862 2,061 4,100

Weighted average shares — diluted ................................ 178,790 179,340 182,911

Net income per share — basic .................................... $0.73 $0.37 $0.60

Net income per share — diluted ................................... $0.72 $0.36 $0.59