Logitech 2011 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.218

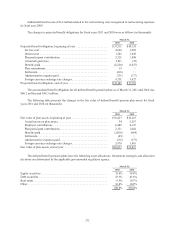

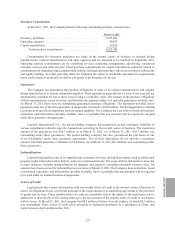

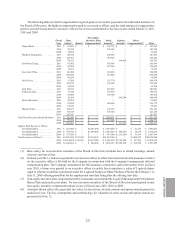

The Company continues to recognize interest and penalties related to unrecognized tax positions in income

tax expense. The Company recognized $1.3 million, $1.9 million and $1.8 million in interest and penalties in

income tax expense during fiscal years 2011, 2010 and 2009. As of March 31, 2011, 2010 and 2009, the Company had

approximately $8.0 million, $12.5 million and $10.7 million of accrued interest and penalties related to uncertain

tax positions.

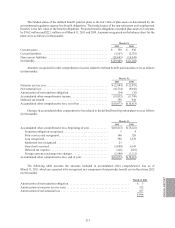

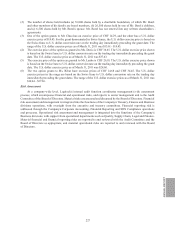

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally not

subject to tax examinations for years prior to 1999. During the third quarter of fiscal year 2011, the U.S. Internal

Revenue Service expanded its examination of the Company’s U.S. subsidiary to include fiscal years 2008 and 2009

in addition to fiscal years 2006 and 2007. At this time it is not possible to estimate the potential impact that the

examination may have on income tax expense. The Company is also under examination in other jurisdictions.

Although the Company has adequately provided for uncertain tax positions, the provisions on these positions

may change as revised estimates are made or the underlying matters are settled or otherwise resolved. Although

the timing of the resolution or closure on audits is highly uncertain, the Company does not believe it is reasonably

possible that the unrecognized tax benefits would materially change in the next twelve months.

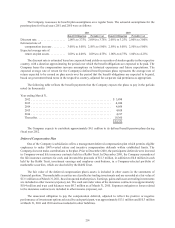

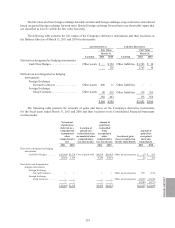

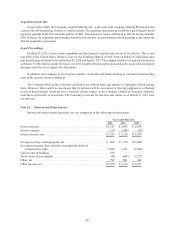

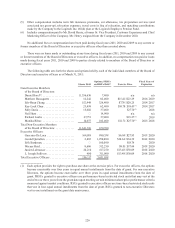

Note 14 — Derivative Financial Instruments — Foreign Exchange Hedging

Cash Flow Hedges

The Company enters into foreign exchange forward contracts to hedge against exposure to changes in foreign

currency exchange rates related to its subsidiaries’ forecasted inventory purchases. The primary risk managed

by using derivative instruments is the foreign currency exchange rate risk. The Company has designated these

derivatives as cash flow hedges. Logitech does not use derivative financial instruments for trading or speculative

purposes. These hedging contracts mature within three months, and are denominated in the same currency as the

underlying transactions. Gains and losses in the fair value of the effective portion of the hedges are deferred as a

component of accumulated other comprehensive loss until the hedged inventory purchases are sold, at which time

the gains or losses are reclassified to cost of goods sold. The Company assesses the effectiveness of the hedges by

comparing changes in the spot rate of the currency underlying the forward contract with changes in the spot rate of

the currency in which the forecasted transaction will be consummated. If the underlying transaction being hedged

fails to occur or if a portion of the hedge does not generate offsetting changes in the foreign currency exposure of

forecasted inventory purchases, the Company immediately recognizes the gain or loss on the associated financial

instrument in other income (expense). Such losses were immaterial during the fiscal years ended March 31, 2011,

2010 and 2009. Cash flows from such hedges are classified as operating activities in the consolidated statements of

cash flows. The notional amounts of foreign exchange forward contracts outstanding related to forecasted inventory

purchases were $54.9 million (€38.7 million) and $46.2 million (€34.3 million) at March 31, 2011 and 2010. The

notional amount represents the future cash flows under contracts to purchase foreign currencies.

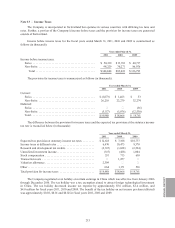

Other Derivatives

The Company also enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables. These forward contracts generally

mature within three months. The Company may also enter into foreign exchange swap contracts to economically

extend the terms of its foreign exchange forward contracts. The primary risk managed by using forward and swap

contracts is the foreign currency exchange rate risk. The gains or losses on foreign exchange forward contracts are

recognized in earnings based on the changes in fair value.

The notional amounts of foreign exchange forward contracts outstanding at March 31, 2011 and 2010 relating

to foreign currency receivables or payables were $12.9 million and $15.1 million. Open forward contracts as of

March 31, 2011 and 2010 consisted of contracts in British pounds to purchase euros at a future date at a predetermined

exchange rate. The notional amounts of foreign exchange swap contracts outstanding at March 31, 2011 and 2010

were $17.1 million and $38.9 million. Swap contracts outstanding at March 31, 2011 consisted of contracts in

Canadian dollars, Japanese yen, and Mexican pesos. Swap contracts outstanding at March 31, 2010 consisted of

contracts in British pounds, Japanese yen, Mexican pesos and Canadian dollars.