Logitech 2011 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

220

Note 15 — Commitments and Contingencies

Operating Leases

The Company leases facilities under operating leases, certain of which require it to pay property taxes,

insurance and maintenance costs. Operating leases for facilities are generally renewable at the Company’s option

and usually include escalation clauses linked to inflation. Future minimum annual rentals under non-cancelable

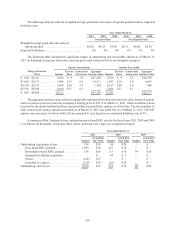

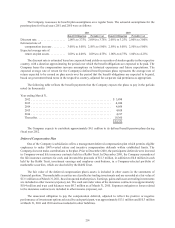

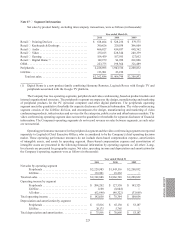

operating leases at March 31, 2011 are as follows (in thousands):

Year ending March 31,

2012 .................................................................. $18,023

2013 .................................................................. 15,594

2014 .................................................................. 9,875

2015 .................................................................. 7,870

2016 .................................................................. 6,962

Thereafter.............................................................. 14,267

$72,591

Rent expense was $19.8 million, $16.3 million and $15.5 million for the years ended March 31, 2011, 2010

and 2009.

In May, 2011 we signed a new lease for facilities which will house our Americas operations in Northern

California, replacing our leased facilities in Fremont, California. Our future contractual obligation in connection

with this lease is approximately $35 million over an 11 year period.

In connection with its leased facilities, the Company has recognized a liability for asset retirement obligations

representing the present value of estimated remediation costs to be incurred at lease expiration. The following table

describes changes to the Company’s asset retirement obligation liability for the years ended March 31, 2011 and

2010 (in thousands):

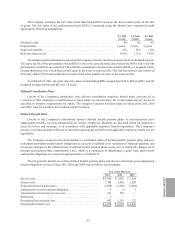

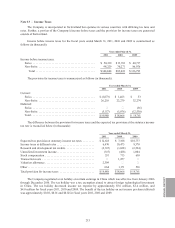

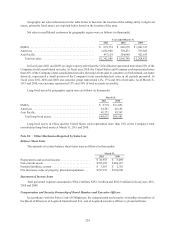

March 31,

2011 2010

Asset retirement obligation, beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,374 $1,255

Liabilities incurred ............................................ 275 44

Liabilities settled .............................................. (120)(18)

Accretion expense ............................................. 71 71

Foreign currency translation ..................................... 36 22

Asset retirement obligation, end of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,636 $1,374

Product Warranties

Certain of the Company’s products are covered by warranty to be free from defects in material and workmanship

for periods ranging from one year to five years. At the time of sale, the Company accrues a warranty liability for

estimated costs to provide products, parts or services to repair or replace products in satisfaction of the warranty

obligation. The Company’s estimate of costs to fulfill its warranty obligations is based on historical experience

and expectations of future conditions. When the Company experiences changes in warranty claim activity or costs

associated with fulfilling those claims, the warranty liability is adjusted accordingly. Changes in the Company’s

warranty liability for the years ended March 31, 2010 and 2011 were as follows (in thousands):

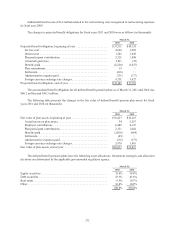

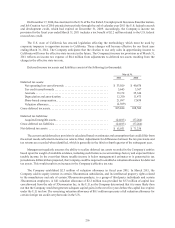

March 31,

2011 2010

Warranty liability, beginning of year ........................................ $3,002 $2,867

Provision for warranties issued during the year .......................... 18,666 16,344

Settlements made during the year ..................................... (16,698)(16,209)

Warranty liability, end of year ............................................. $ 4,970 $3,002