Logitech 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

131

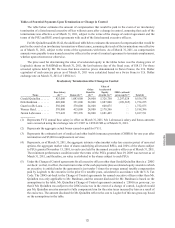

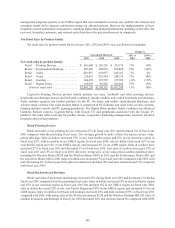

Retail sales in fiscal year 2011 increased 15% and retail units increased 19% compared with fiscal year 2010,

with increases in all product families except gaming. Our overall retail average selling price in fiscal year 2011

declined 3% compared with fiscal year 2010, as unit sales of our retail products priced below $40 increased more

than other price bands.

Retail sales in our Asia Pacific and AMR regions increased 37% and 28% in fiscal year 2011 compared with

fiscal year 2010. Retail sales in our EMEA region decreased 2% in the same period, reflecting a disappointing

decline of 17% in the fourth quarter of fiscal year 2011 compared with the fourth quarter of fiscal year 2010. The

weakness in the EMEA region in the fourth quarter of fiscal year 2011 was due to lower than expected demand and

poor execution of pricing and channel programs in Europe.

OEM sales increased 13% in fiscal year 2011 compared with fiscal year 2010, and OEM units sold increased

9%, primarily due to increased keyboard sales.

Sales of LifeSize Communications products were 6% of total net sales in fiscal year 2011. In fiscal year 2010,

LifeSize sales were included in our financial results from December 9, 2009, the date of acquisition, to the end of

the fiscal year.

Our gross margin for fiscal year 2011 was 35.4% compared with 31.9% in the prior fiscal year, primarily due

to the a favorable shift in product mix towards products with higher margin, operational efficiencies in our supply

chain costs, and lower obsolescence write-downs, somewhat offset by the negative impact of the weaker euro

during most of fiscal year 2011. Our gross margin for fiscal year 2011 would have been higher but for weak sales

and profitability in our EMEA retail region in the fourth quarter. Operating expenses for fiscal year 2011 were

29.4% of net sales compared with 27.9% in fiscal year 2010. The increase in operating expenses was primarily due

to the addition of LifeSize in December 2009, increased advertising and marketing expenses related to promotional

campaigns for Harmony and Logitech Revue, and increased investment in areas of future growth opportunities,

such as China.

Net income for the year ended March 31, 2011 was $128.5 million, compared with net income of $65.0 million

in fiscal year 2010. The increase in net income was primarily due to increased sales and improved gross margin,

somewhat offset by the increase in operating expenses.

Trends in Our Business

Our sales of PC peripherals for use by consumers in the Americas and Europe have historically made up the

large majority of our revenues. The increasing popularity of smaller, mobile computing devices such as tablets and

smartphones with touch interfaces and the declining popularity of desktop PCs is rapidly changing the PC market.

Consumer demand for PCs is decelerating in our traditional, mature markets such as North America, Western and

Nordic Europe, Japan, Australia, and New Zealand, and we believe sales of our PC peripherals in mature markets

will decline in fiscal year 2012 and potentially beyond. We believe there are continued growth opportunities for our

PC peripherals outside the more mature markets of the Americas and Europe. We also believe there are significant

opportunities to sell products to consumers to help make their tablets and other mobile devices more productive

and comfortable. However, we only recently introduced our product line for tablets, and consumer acceptance and

demand for peripherals for use with tablets and other mobile computing devices is still uncertain. We believe our

future sales growth will be significantly impacted by our ability to grow sales in emerging markets such as China,

to grow our LifeSize videoconferencing division, and to develop sales and innovations for our emerging product

categories which are not PC-dependent, such as our products for tablets and the Google TV platform.

Our overall corporate strategy for future growth includes increasing our presence and sales in emerging

markets, which we anticipate will be the high growth markets of the future as sales growth decelerates in our

traditional, mature markets. We are currently investing significantly in growing the number of our sales, marketing

and administrative personnel in China, and we expect that China may represent one of our top three countries, by