Logitech 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

147

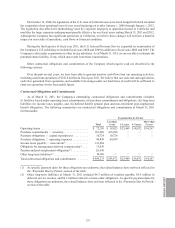

The change in the effective income tax rate to 13.5% in fiscal year 2011 compared with 22.3% in fiscal year

2010 is due to discrete tax benefits of $13.5 million from the expiration of statutes of limitations and the closure

of income tax audits in certain jurisdictions. The increase in the effective income tax rate to 22.3% in fiscal year

2010 compared with 15.6% in fiscal year 2009 is primarily due to the mix of income and losses in the various tax

jurisdictions in which we operate.

On December 17, 2010, the enactment in the U.S. of the Tax Relief, Unemployment Insurance Reauthorization,

and Job Creation Act of 2010 extended retroactively through the end of calendar year 2011 the U.S. federal research

and development tax credit which had expired on December 31, 2009. Accordingly, the Company’s income tax

provision for fiscal year 2011 includes a tax benefit of $2.2 million related to the U.S. federal research tax credit.

As of March 31, 2011 and 2010, the total amount of unrecognized tax benefits and related accrued interest and

penalties due to uncertain tax positions was $138.1 million and $125.2 million, of which $118.2 million and $101.4

million would affect the effective income tax rate if recognized. The increase in income tax liability associated

with uncertain tax positions in fiscal year 2011 was offset by expiration of statutes of limitations and the closure of

income tax audits in certain jurisdictions.

The Company continues to recognize interest and penalties related to unrecognized tax positions in income

tax expense. As of March 31, 2011 and 2010, the Company had approximately $8.0 million and $12.5 million of

accrued interest and penalties related to uncertain tax positions.

The Company files Swiss and foreign tax returns. For all these tax returns, the Company is generally not

subject to tax examinations for years prior to 1999. During the third quarter of fiscal year 2011, the U.S. Internal

Revenue Service expanded its examination of the Company’s U.S. subsidiary to include fiscal years 2008 and 2009

in addition to fiscal years 2006 and 2007. At this time it is not possible to estimate the potential impact that the

examination may have on income tax expense. The Company is also under examination in other tax jurisdictions.

Although the timing of the resolution or closure on audits is highly uncertain, the Company does not believe it is

reasonably possible that the unrecognized tax benefits would materially change in the next twelve months.

Liquidity and Capital Resources

Cash Balances, Available Borrowings, and Capital Resources

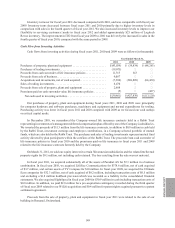

At March 31, 2011, our working capital was $605.7 million, compared with $353.4 million at March 31, 2010.

The increase in working capital over the prior year was due to increases in accounts receivable and inventories

related to the increase in sales in fiscal year 2011, and a higher comparative cash balance. In fiscal year 2010, we

paid cash of $378.6 million for the acquisition of LifeSize.

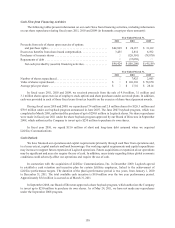

During fiscal year 2011, operating activities provided net cash of $156.6 million, generated from operations

and increases in accounts payable. We used $39.9 million in investing activities, including $43.0 million for

investments in tooling, computer hardware and software, and equipment. Net cash provided by financing activities

was $46.4 million, primarily from the proceeds of employee stock purchases and the exercise of stock options.

At March 31, 2011, we had cash and cash equivalents of $477.9 million, comprised of bank demand deposits

and short-term time deposits. Cash and cash equivalents are carried at cost, which is equivalent to fair value.

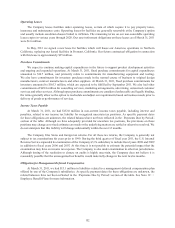

The Company has credit lines with several European and Asian banks totaling $117.1 million as of March 31,

2011. As is common for businesses in European and Asian countries, these credit lines are uncommitted and

unsecured. Despite the lack of formal commitments from the banks, we believe that these lines of credit will

continue to be made available because of our long-standing relationships with these banks and our current financial

condition. At March 31, 2011, there were no outstanding borrowings under these lines of credit. There are no

financial covenants under these facilities.