Logitech 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

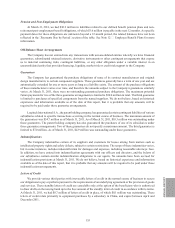

We provide various third parties with irrevocable letters of credit in the normal course of business to secure

our obligations to pay or perform pursuant to the requirements of an underlying agreement or the provision of goods

and services. These standby letters of credit are cancelable only at the option of the beneficiary who is authorized

to draw drafts on the issuing bank up to the face amount of the standby letter of credit in accordance with its terms.

At March 31, 2011, we had $0.7 million of letters of credit in place, of which $0.1 million was outstanding. These

letters of credit relate primarily to equipment purchases by a subsidiary in China, and expire between April and

December 2011.

The Company has financed its operating and capital requirements primarily through cash flow from operations

and, to a lesser extent, from capital markets and bank borrowings. Our normal short-term liquidity and long-term

capital resource requirements are provided from three sources: cash flow generated from operations, cash and cash

equivalents on hand, and borrowings, as needed, under our credit facilities.

Based upon our available cash balances and credit lines, and the trend of our historical cash flow generation,

we believe we have sufficient liquidity to fund operations for the foreseeable future.

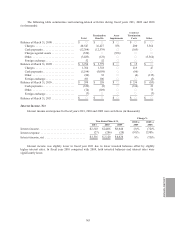

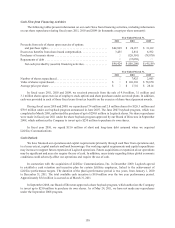

Cash Flow from Operating Activities

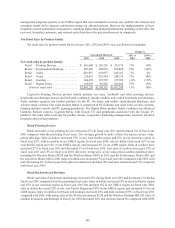

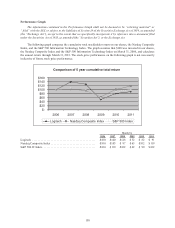

The following table presents selected financial information and statistics for fiscal years 2011, 2010 and 2009

(dollars in thousands):

Year Ended March 31,

2011 2010 2009

Accounts receivable, net ......................................... $258,294 $195,247 $213,929

Inventories ................................................... $280,814 $219,593 $233,467

Working capital ................................................ $605,666 $353,370 $709,382

Days sales in accounts receivable (DSO)(1). . . . . . . . . . . . . . . . . . . . . . . . . . . 42 days 33 days 47 days

Inventory turnover (ITO)(2) ....................................... 5.2x 6.1x 5.2x

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 156,551 $365,259 $200,587

(1) DSO is determined using ending accounts receivable as of the most recent quarter-end and net sales for the

most recent quarter.

(2) ITO is determined using ending inventories and annualized cost of goods sold (based on the most recent

quarterly cost of goods sold).

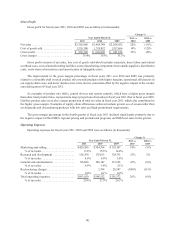

During fiscal year 2011, the Company’s operating activities generated net cash of $156.6 million, compared

with $365.3 million in 2010 and $200.6 million in 2009. The decrease in 2011 was the result of higher accounts

receivable and inventory balances, due to increased sales, higher DSO, and inventory of the new Logitech Revue

product, and smaller increases than fiscal year 2010 in accounts payable and accrued liabilities. The increase in

cash provided by operating activities was higher in 2010 primarily due to targeted management of working capital,

reflected in the lower DSO and higher ITO.

DSO for fiscal year 2011 increased by 9 days compared with fiscal year 2010 and decreased by 5 days over

fiscal year 2009. The increase related to a decline in shipment linearity and slight changes in payment terms, as

well as changes in the types of incentive promotions offered, which resulted in classification of the related accruals

as a liability rather than a deduction from accounts receivable. The decrease in fiscal year 2010 over 2009 resulted

from improved cash collections and increased order and shipment linearity.

Typical payment terms require customers to pay for product sales generally within 30 to 60 days; however,

terms may vary by customer type, by country and by selling season. Extended payment terms are sometimes

offered to a limited number of customers during the second and third fiscal quarters. The Company does not

modify payment terms on existing receivables, but may offer discounts for early payment.