Logitech 2011 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

202

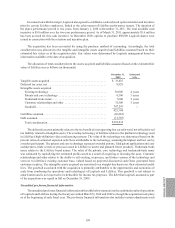

The acquisition has been accounted for using the purchase method of accounting. Accordingly, the total

consideration was allocated to the tangible and intangible assets acquired and liabilities assumed based on their

estimated fair values as of the acquisition date. Fair values were determined by Company management based

on information available at the date of acquisition. The results of operations of Ultimate Ears were included in

Logitech’s consolidated financial statements from the date of acquisition, and were not material to the Company’s

reported results.

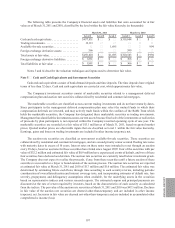

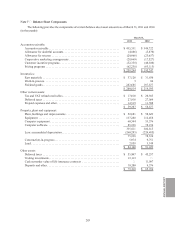

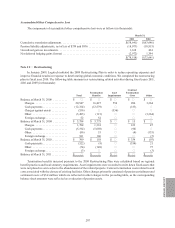

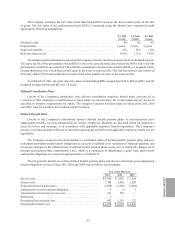

The allocation of total consideration, including transaction costs, to the assets acquired and liabilities assumed

based on the estimated fair value of Ultimate Ears was as follows (in thousands):

August 19,

2008 Estimated

Life

Tangible assets acquired ....................................... $ 4,132

Intangible assets acquired

Existing technology ........................................ 5,900 4 years

Patents and core technology ................................. 1,900 4 years

Trademark/trade name...................................... 2,900 5 years

Customer relationships and other ............................. 2,500 5 years

Goodwill................................................. 25,254 —

42,586

Liabilities assumed ........................................... (2,845)

Deferred tax liability, net....................................... (5,235)

Total consideration......................................... $34,506

The existing technology of Ultimate Ears relates to the technical components used in the in-ear monitors and

earplugs. The value of the technology was determined based on the present value of estimated expected cash flows

attributable to the technology. The patents and core technology represent awarded patents, filed patent applications

and core architectures used in Ultimate Ears’ current and planned future products. Trademark/trade name relates to

the Ultimate Ears brand names. The value of the patents, core technology and trademark/trade name was estimated

by capitalizing the estimated profits saved as a result of acquiring or licensing the asset. Customer relationships and

other relates to Ultimate Ears’ existing customer base, valued based on projected discounted cash flows generated

from customers in place. The intangible assets acquired are amortized on a straight-line basis over their estimated

useful lives. The goodwill associated with the acquisition is not subject to amortization and is not expected to be

deductible for income tax purposes. The deferred tax liability relates to the acquired intangible assets which are

also not expected to be deductible for income tax purposes.

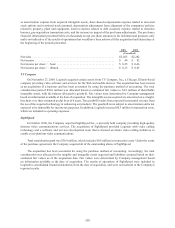

3Dconnexion

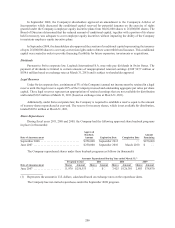

On March 31, 2011, the Company sold its equity interest in certain 3Dconnexion subsidiaries, the provider

of the Company’s 3D controllers, and its intellectual property rights related to the manufacture and sale of certain

3Dconnexion products, to a group of third party individuals and certain 3Dconnexion employees. The sale price

was $9.1 million, not including cash retained. Under the sale agreement, the Company will continue to manufacture

3Dconnexion products and sell to the buyers for a period of three years. The loss resulting from the sale was

not material.