Logitech 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

149

Inventory turnover for fiscal year 2011 decreased compared with 2010, and was comparable with fiscal year

2009. Inventory turns decreased between fiscal years 2011 and 2010 primarily due to higher inventory levels in

comparison with sales in the fourth quarter of fiscal year 2011. We also increased inventory levels to improve our

flexibility in servicing customers’ needs in fiscal year 2012 and added approximately $25 million of Logitech

Revue inventory. The improvement in ITO from fiscal year 2009 to 2010 was driven by the increased in sales in the

fourth quarter of fiscal year 2010, compared with the same period in 2009.

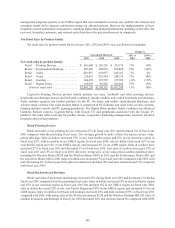

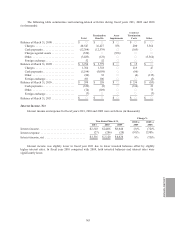

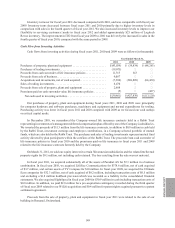

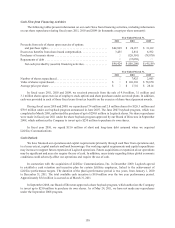

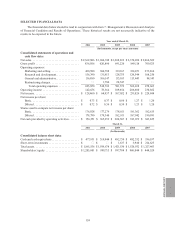

Cash Flow from Investing Activities

Cash flows from investing activities during fiscal years 2011, 2010 and 2009 were as follows (in thousands):

Year Ended March 31,

2011 2010 2009

Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . $(43,039) $ (39,834) $ (48,263)

Purchases of trading investments ................................ (19,075) — —

Proceeds from cash surrender of life insurance policies .............. 11,313 813 —

Proceeds from sale of business .................................. 9,087 — —

Acquisitions and investments, net of cash acquired. . . . . . . . . . . . . . . . . . (7,300)(388,809)(64,430)

Sales of trading investments .................................... 6,470 — —

Proceeds from sale of property, plant and equipment . . . . . . . . . . . . . . . . 2,688 — —

Premiums paid on cash surrender value life insurance policies . . . . . . . . (5) — (427)

Net cash used in investing activities ........................... $(39,861) $(427,830) $(113,120)

Our purchases of property, plant and equipment during fiscal years 2011, 2010 and 2009 were principally

for computer hardware and software purchases, machinery and equipment and normal expenditures for tooling.

Purchasing activity was lower in fiscal years 2011 and 2010 compared with 2009 as we focused our cash outlays

on critical capital needs.

In December 2010, we surrendered the Company-owned life insurance contracts held in a Rabbi Trust

representing investments of a management deferred compensation plan offered by one of the Company’s subsidiaries.

We invested the proceeds of $11.3 million from the life insurance contracts, in addition to $0.8 million in cash held

by the Rabbi Trust, investment earnings and employee contributions, in a Company-selected portfolio of mutual

funds, which are also held in the Rabbi Trust. The purchases and sales of trading investments represent mutual fund

activity directed by plan participants within the confines of the Rabbi Trust. The proceeds from cash surrender of

life insurance policies in fiscal year 2010 and the premiums paid on life insurance in fiscal years 2011 and 2009

related to the life insurance contracts formerly held by the Company.

On March 31, 2011, we sold our equity interest in certain 3Dconnexion subsidiaries and the related intellectual

property rights for $9.1 million, not including cash retained. The loss resulting from the sale was not material.

In fiscal year 2011, we acquired substantially all of the assets of Paradial AS for $7.3 million in a business

combination. In fiscal year 2010, we acquired LifeSize Communications for $378.6 million, net of cash acquired

of $3.7 million, and certain assets of TV Compass for $10 million. In fiscal year 2009, we acquired the Ultimate

Ears companies for $32.3 million, net of cash acquired of $0.2 million, including transaction costs of $0.5 million

and excluding a $1.8 million holdback provision which was recorded as a liability in the consolidated financial

statements. We also acquired SightSpeed in fiscal year 2009 for $30.9 million in cash including transaction costs of

$0.8 million. In addition, we paid $2.0 million for a pre-acquisition contingency recorded during the third quarter

of fiscal year 2009 related to our WiLife acquisition and $0.4 million for patent rights acquired pursuant to a patent

settlement agreement.

Proceeds from the sale of property, plant and equipment in fiscal year 2011 were related to the sale of our

building in Romanel, Switzerland.