Logitech 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

151

On October 12, 2010, the legislature of the U.S. state of California enacted a fiscal budget bill which extended

the suspension of net operating losses for tax years beginning on or after January 1, 2008 through January 1, 2012.

The legislation also affects the methodology used by corporate taxpayers to apportion income to California and

modifies the large corporate underpayment penalty effective for our fiscal years ending March 31, 2011 and 2012.

Although the Company has significant operations in California, we believe these changes will not have a material

impact on our results of operations, cash flows or financial condition.

During the third quarter of fiscal year 2011, the U.S. Internal Revenue Service expanded its examination of

the Company’s U.S. subsidiary to include fiscal years 2008 and 2009 in addition to fiscal years 2006 and 2007. The

Company is also under examination in other tax jurisdictions. As of March 31, 2011, we are not able to estimate the

potential future liability, if any, which may result from these examinations.

Other contractual obligations and commitments of the Company which require cash are described in the

following sections.

Over the past several years, we have been able to generate positive cash flow from our operating activities,

including cash from operations of $156.6 million in fiscal year 2011. We believe that our cash and cash equivalents,

cash flow generated from operations, and available borrowings under our bank lines of credit will be sufficient to

fund our operations for the foreseeable future.

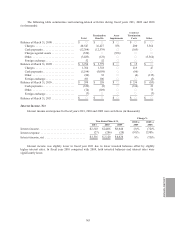

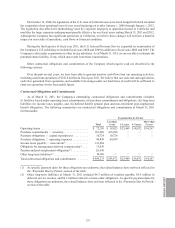

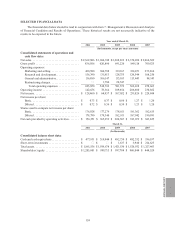

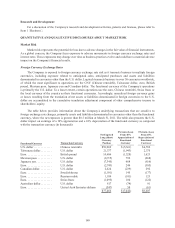

Contractual Obligations and Commitments

As of March 31, 2011, the Company’s outstanding contractual obligations and commitments included:

(i) facilities leased under operating lease commitments, (ii) purchase commitments and obligations, (iii) long-term

liabilities for income taxes payable, and (iv) defined benefit pension plan and non-retirement post-employment

benefit obligations. The following summarizes our contractual obligations and commitments at March 31, 2011

(in thousands):

Payments Due by Period

Total Less than

1 year 1-3 years 4-5 years More than

5 years

Operating leases ................................. $72,591 $18,023 $25,469 $14,832 $14,267

Purchase commitments — inventory ................. 165,286 165,286 — — —

Purchase obligations — capital expenditures . . . . . . . . . . 10,724 10,724 — — —

Purchase obligations — operating expenses . . . . . . . . . . . 49,839 49,839

Income taxes payable — non-current(1) ............... 131,968

Obligation for management deferred compensation(1) .... 13,076

Pension and post-employment obligations(1). . . . . . . . . . . . 26,645

Other long-term liabilities(2) ........................ 14,146 — — — —

Total contractual obligations and commitments . . . . . . . . $484,275 $243,872 $25,469 $14,832 $14,267

(1) As specific payment dates for these obligations are unknown, the related balances have not been reflected in

the “Payments Due by Period” section of the table.

(2) Other long-term liabilities at March 31, 2011 included $4.3 million of royalties payable, $5.6 million in

deferred service revenue, and $4.2 million related to various other obligations. As specific payment dates for

these obligations are unknown, the related balances have not been reflected in the “Payments Due by Period”

section of the table.