Logitech 2011 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

193

When property and equipment is retired or otherwise disposed of, the cost and accumulated depreciation are

relieved from the accounts and the net gain or loss is included in the determination of net income.

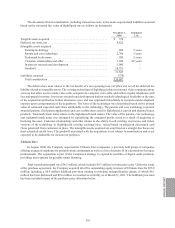

Goodwill and Other Intangible Assets

The Company’s intangible assets principally include goodwill, acquired technology, trademarks, customer

contracts and customer relationships, and other. Intangible assets with finite lives, which include acquired technology,

trademarks, customer contracts and customer relationships, and other, are recorded at cost and amortized using

the straight-line method over their useful lives ranging from one year to ten years. Intangible assets with indefinite

lives, which include goodwill, are recorded at cost and evaluated at least annually for impairment.

Impairment of Long-Lived Assets

The Company reviews long-lived assets, such as investments, property and equipment, and intangible assets,

for impairment whenever events indicate that the carrying amounts might not be recoverable. Recoverability

of investments, property and equipment, and other intangible assets is measured by comparing the projected

undiscounted net cash flows associated with those assets to their carrying values. If an asset is considered impaired,

it is written down to fair value, which is determined based on the asset’s projected discounted cash flows or

appraised value, depending on the nature of the asset.

Goodwill is evaluated for impairment at least annually and whenever events or changes in circumstances

indicate that the carrying amount may not be recoverable from estimated future cash flows. Recoverability of

goodwill is measured at the reporting unit level by comparing the reporting unit’s carrying amount, including

goodwill, to the fair value of the reporting unit. If the carrying amount of the reporting unit exceeds its fair value,

goodwill is considered impaired, and a second test is performed to measure the amount of the impairment loss.

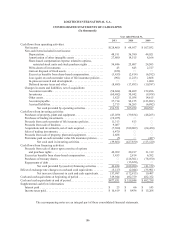

Income Taxes

The Company provides for income taxes using the liability method, which requires that deferred tax assets

and liabilities be recognized for the expected future tax consequences of temporary differences resulting from

differing treatment of items for tax and accounting purposes. In estimating future tax consequences, expected

future events are taken into consideration, with the exception of potential tax law or tax rate changes.

The Company’s assessment of uncertain tax positions requires that management make estimates and judgments

about the application of tax law, the expected resolution of uncertain tax positions and other matters. In the event

that uncertain tax positions are resolved for amounts different than the Company’s estimates, or the related statutes

of limitations expire without the assessment of additional income taxes, the Company will be required to adjust the

amounts of the related assets and liabilities in the period in which such events occur. Such adjustments may have a

material impact on the Company’s income tax provision and its results of operations.

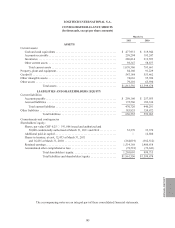

Fair Value of Financial Instruments

The carrying value of certain of the Company’s financial instruments, including cash, cash equivalents,

accounts receivable, accounts payable and accrued liabilities approximates fair value due to their short maturities.

The Company’s trading investments are reported at fair value based on quoted market prices, and available-for-sale

securities are reported at estimated fair value.

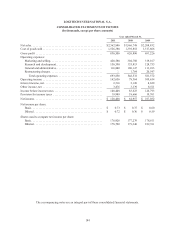

Net Income per Share

Basic net income per share is computed by dividing net income by the weighted average outstanding shares.

Diluted net income per share is computed using the weighted average outstanding shares and dilutive share

equivalents. Dilutive share equivalents consist of share-based compensation awards, including stock options and

restricted stock.