Logitech 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198

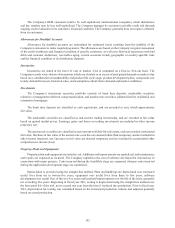

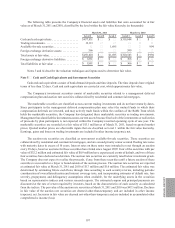

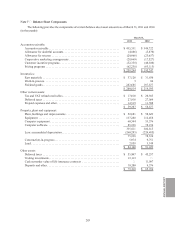

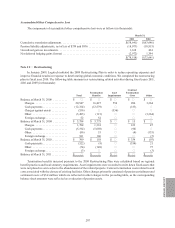

The following table presents the changes in fair value of the Company’s auction rate securities during fiscal

years 2011 and 2010:

March 31,

2011 2010

Auction rate securities, beginning balance....................................... $994 $1,637

Unrealized gain ......................................................... 744 —

Unrealized loss.......................................................... (43)(643)

Auction rate securities, ending balance.......................................... $1,695 $994

Note 6 — Acquisitions and Divestitures

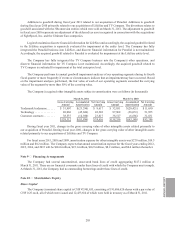

Paradial

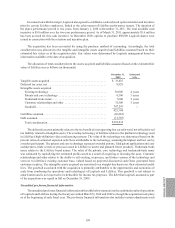

On July 6, 2010, Logitech acquired substantially all of the assets and employees of Paradial AS, a Norwegian

company providing firewall and NAT (network address translation) traversal solutions for video communications.

The acquisition will allow the Company to closely integrate firewall and NAT traversal across its video

communications product portfolio, enabling end-to-end HD video calling over highly protected networks. The

acquisition has been treated as an acquisition of a business and has been accounted for using the purchase method of

accounting. The total consideration paid of $7.3 million was allocated based on estimated fair values to $7.0 million

of identifiable intangible assets and $0.1 million of assumed liabilities, with the remaining balance allocated to

goodwill. The intangible assets acquired are amortized on a straight-line basis over their estimated useful lives

of five years. The goodwill associated with the acquisition is not subject to amortization and is not expected to be

deductible for income tax purposes.

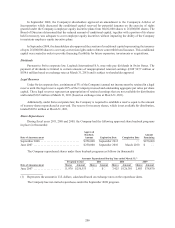

LifeSize

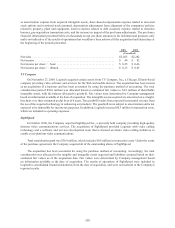

On December 11, 2009, pursuant to a merger agreement signed November 10, 2009, Logitech acquired LifeSize

Communications, Inc., an Austin, Texas-based privately-held company specializing in high definition video

communication products and services. Logitech expects the acquisition to drive growth in video communication

for the enterprise and small-to-medium business markets by leveraging the two companies’ technology expertise,

including camera design, firewall traversal, video compression and bandwidth management.

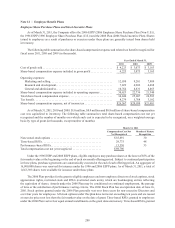

The total consideration paid to acquire LifeSize was $382.8 million, not including cash acquired of $3.7 million.

In addition, Logitech incurred $6.6 million in transaction costs, which are included in operating expenses. Logitech

paid $382.3 million in cash to the holders of all outstanding shares of LifeSize capital stock, all vested options

issued by LifeSize, and all outstanding warrants to purchase LifeSize stock. As part of the acquisition, Logitech

assumed all outstanding unvested LifeSize stock options and unvested restricted stock held by continuing LifeSize

employees at December 11, 2009. The assumed options are exercisable for a total of approximately 1.0 million

Logitech shares and the assumed restricted stock was exchanged for 0.1 million Logitech shares. The stock options

and restricted stock continue to have the same terms and conditions as under LifeSize’s option plan. The fair value

attributable to precombination employee services for the stock options assumed, which is part of the consideration

paid to acquire LifeSize, was $0.5 million. The weighted average fair value of $12.07 per share for the stock

options assumed was determined using a Black-Scholes-Merton option-pricing valuation model with the following

weighted-average assumptions: expected term of 2.0 years, expected volatility of 57%, and risk-free interest rate

of 0.7%.

The total cash consideration paid of $382.3 million included $37.0 million deposited into an escrow account

as security for indemnification claims under the merger agreement and $0.5 million deposited in a stockholder

representative expense fund. The escrow trustee disbursed 50% of the escrow fund to the former holders of LifeSize

capital stock, vested options and warrants in December 2010, and the remaining fifty percent will be disbursed in

June 2011, subject to indemnification claims.