Logitech 2011 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

205

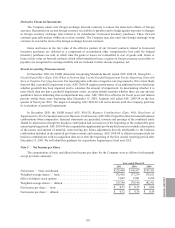

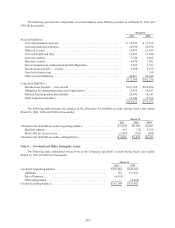

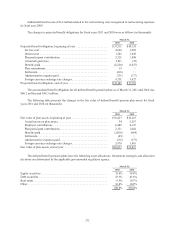

Additions to goodwill during fiscal year 2011 related to our acquisition of Paradial. Additions to goodwill

during fiscal year 2010 primarily related to our acquisitions of LifeSize and TV Compass. The divestiture relates to

goodwill associated with the 3Dconnexion entities which were sold on March 31, 2011. The adjustment to goodwill

in fiscal year 2010 represents an adjustment of the deferred tax asset recognized in connection with the acquisitions

of SightSpeed, Inc. and the Ultimate Ears companies.

Logitech maintains discrete financial information for LifeSize and accordingly, the acquired goodwill related

to the LifeSize acquisition is separately evaluated for impairment at the entity level. The Company has fully

integrated the Paradial business into LifeSize, and discrete financial information for Paradial is not maintained.

Accordingly, the acquired goodwill related to Paradial is evaluated for impairment at the LifeSize entity level.

The Company has fully integrated the TV Compass business into the Company’s other operations, and

discrete financial information for TV Compass is not maintained. Accordingly, the acquired goodwill related to

TV Compass is evaluated for impairment at the total enterprise level.

The Company performs its annual goodwill impairment analyses of our operating segments during its fourth

fiscal quarter or more frequently if events or circumstances indicate that an impairment may have occurred. Based

on the impairment analyses performed, the fair value of each of our operating segments exceeded the carrying

value of the segment by more than 50% of the carrying value.

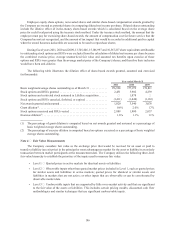

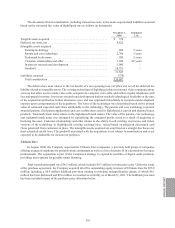

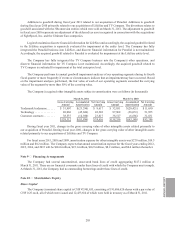

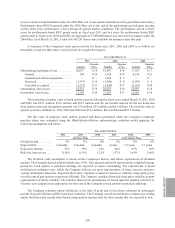

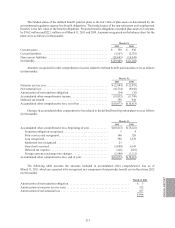

The Company’s acquired other intangible assets subject to amortization were as follows (in thousands):

March 31, 2011 March 31, 2010

Gross Carrying

Amount Accumulated

Amortization Net Carrying

Amount Gross Carrying

Amount Accumulated

Amortization Net Carrying

Amount

Trademark/tradename. . . . . . $ 31,907 $(23,290) $ 8,617 $ 32,051 $(20,421) $11,630

Technology . . . . . . . . . . . . . . 88,068 (45,686) 42,382 87,968 (36,033) 51,935

Customer contracts ........ 38,537 (14,920) 23,617 38,517 (6,686) 31,831

$158,512 $(83,896) $74,616 $158,536 $(63,140) $95,396

During fiscal year 2011, changes in the gross carrying value of other intangible assets related primarily to

our acquisition of Paradial. During fiscal year 2010, changes in the gross carrying value of other intangible assets

related primarily to our acquisitions of LifeSize and TV Compass.

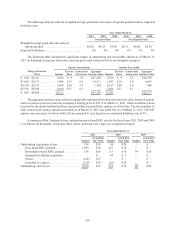

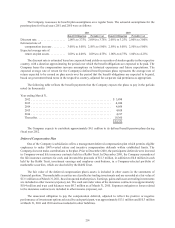

For fiscal years 2011, 2010 and 2009, amortization expense for other intangible assets was $27.8 million, $14.5

million and $8.2 million. The Company expects that annual amortization expense for the fiscal years ending 2012,

2013, 2014, and 2015 will be $26.0 million, $23.1 million, $16.9 million, $8.2 million, and $0.4 million thereafter.

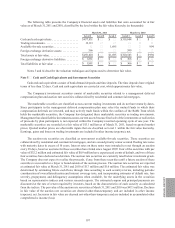

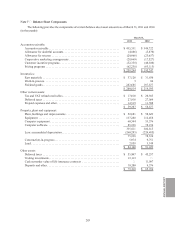

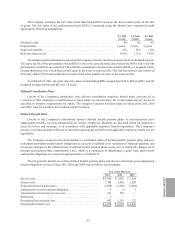

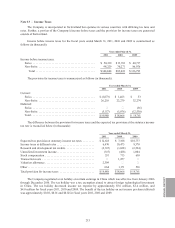

Note 9 — Financing Arrangements

The Company had several uncommitted, unsecured bank lines of credit aggregating $117.1 million at

March 31, 2011. There are no financial covenants under these lines of credit with which the Company must comply.

At March 31, 2011, the Company had no outstanding borrowings under these lines of credit.

Note 10 — Shareholders’ Equity

Share Capital

The Company’s nominal share capital is CHF 47,901,655, consisting of 191,606,620 shares with a par value of

CHF 0.25 each, all of which were issued and 12,433,614 of which were held in treasury as of March 31, 2011.