Logitech 2011 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.194

The dilutive effect of in-the-money share-based compensation awards is calculated based on the average share

price for each fiscal period using the treasury stock method, which assumes that the amount used to repurchase

shares includes the amount the employee must pay for exercising share-based awards, the amount of compensation

cost not yet recognized for future service, and the amount of tax impact that would be recorded in additional paid-in

capital when the award becomes deductible.

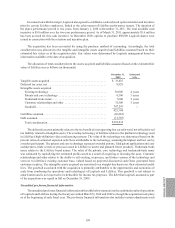

Share-Based Compensation Expense

Share-based compensation expense includes compensation expense, reduced for estimated forfeitures, for

share-based compensation awards granted after April 1, 2006 based on the grant-date fair value. The grant date

fair value for stock options and stock purchase rights is estimated using the Black-Scholes-Merton option-pricing

valuation model. The grant date fair value of RSUs (restricted stock units) which vest upon meeting certain market

conditions is estimated using the Monte-Carlo simulation method. The grant date fair value of time-based RSUs is

calculated based on the share market price on the date of grant. For stock options and restricted stock assumed by

Logitech when LifeSize was acquired, the grant date used to estimate fair value is deemed to be December 11, 2009,

the date of acquisition. Compensation expense for awards granted or assumed after April 1, 2006 is recognized on

a straight-line basis over the service period of the award, which is generally the vesting term of four years (single-

option approach) for stock options and one to four years for RSUs.

For share-based compensation awards granted prior to but not yet vested as of April 1, 2006, share-based

compensation expense is based on the grant-date fair value estimated using the Black-Scholes-Merton option-

pricing valuation model reduced for estimated forfeitures. Compensation expense for these awards is recognized

on a straight-line basis over the service period for each separately vesting portion of the award (multiple-

option approach).

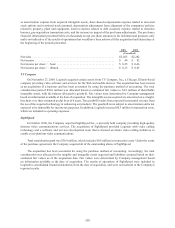

Tax benefits resulting from the exercise of stock options are classified as cash flows from financing activities

in the consolidated statement of cash flows. Excess tax benefits are realized tax benefits from tax deductions

for exercised options in excess of the deferred tax asset attributable to share-based compensation costs for

such options.

The Company will recognize a benefit from share-based compensation in paid-in capital only if an incremental

tax benefit is realized after all other available tax attributes have been utilized. For income tax footnote disclosure,

the Company has elected to offset deferred tax assets against the valuation allowance related to the net operating

loss and tax credit carryforwards from accumulated tax benefits. The Company will recognize these tax benefits

in paid-in capital when the deduction reduces cash taxes payable. In addition, the Company has elected to account

for the indirect benefits of share-based compensation on the research tax credit through the income statement

(continuing operations) rather than through paid-in capital.

Comprehensive Income

Comprehensive income is defined as the total change in shareholders’ equity during the period other than from

transactions with shareholders. Comprehensive income consists of net income and other comprehensive income,

a component of shareholders’ equity. Other comprehensive income is comprised of foreign currency translation

adjustments from those entities not using the U.S. dollar as their functional currency, unrealized gains and losses

on marketable equity securities, net deferred gains and losses and prior service costs for defined benefit pension

plans, and net deferred gains and losses on hedging activity.

Treasury Shares

The Company periodically repurchases shares in the market at fair value. Treasury shares repurchased are

recorded at cost, as a reduction of total shareholders’ equity. Treasury shares held are reissued to satisfy the exercise

of employee stock options and purchase rights, and the vesting of restricted stock units.