Logitech 2011 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

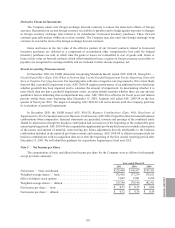

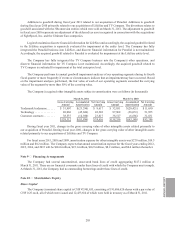

200

as amortization expense from acquired intangible assets, share-based compensation expense related to unvested

stock options and restricted stock assumed, depreciation adjustments from alignment of the companies’ policies

related to property, plant and equipment, interest expense related to debt assumed, expense related to retention

bonuses, pre-acquisition transaction costs, and the income tax impact of the pro forma adjustments. The pro forma

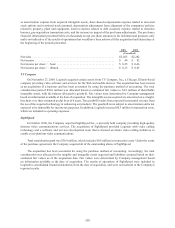

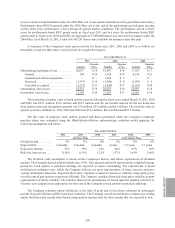

financial information presented below (in thousands except per share amounts) is for informational purposes only

and is not indicative of the results of operations that would have been achieved if the acquisition had taken place at

the beginning of the periods presented.

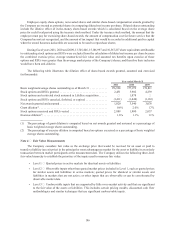

2010 2009

(Unaudited)

Net sales ......................................................... $2,023 $2,282

Net income ....................................................... $ 44 $82

Net income per share — basic ........................................ $ 0.25 $0.46

Net income per share — diluted ....................................... $0.25 $0.45

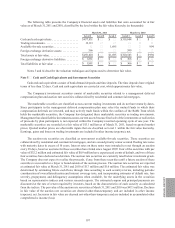

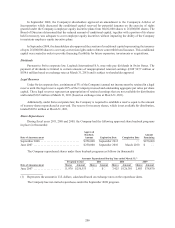

TV Compass

On November 27, 2009, Logitech acquired certain assets from TV Compass, Inc., a Chicago, Illinois-based

company providing video software and services for the Web and mobile devices. The acquisition has been treated

as an acquisition of a business and has been accounted for using the purchase method of accounting. The total

consideration paid of $10.0 million was allocated based on estimated fair values to $4.2 million of identifiable

intangible assets, with the balance allocated to goodwill. Fair values were determined by Company management

based on information available at the date of acquisition. The intangible assets acquired are amortized on a straight-

line basis over their estimated useful lives of 6 years. The goodwill results from expected incremental revenue from

the use of the acquired technology in enhancing our products. The goodwill is not subject to amortization and is not

expected to be deductible for income tax purposes. In addition, Logitech incurred $0.3 million in transaction costs,

which are included in operating expenses.

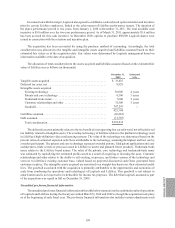

SightSpeed

In October 2008, the Company acquired SightSpeed Inc., a privately held company providing high-quality

Internet video communications services. The acquisition of SightSpeed provided Logitech with video calling

technology and a software and services development team that is focused on future video calling initiatives to

enable cross-platform video communications.

Total consideration paid was $30.9 million, which includes $0.8 million in transaction costs. Under the terms

of the purchase agreement, the Company acquired all of the outstanding shares of SightSpeed.

The acquisition has been accounted for using the purchase method of accounting. Accordingly, the total

consideration was allocated to the tangible and intangible assets acquired and liabilities assumed based on their

estimated fair values as of the acquisition date. Fair values were determined by Company management based

on information available at the date of acquisition. The results of operations of SightSpeed were included in

Logitech’s consolidated financial statements from the date of acquisition, and were not material to the Company’s

reported results.