Logitech 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

ENglISH

Severance and related benefits

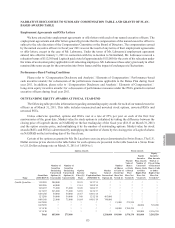

All named executive officers are eligible to receive benefits under certain conditions in accordance with

Logitech’s Change of Control Severance Agreement (Change of Control Agreement), as described in the section

“Potential Payments Upon Termination or Change in Control.”

The purpose of the Change of Control Agreements is to support retention in the event of a prospective change

of control. Should a change of control occur, benefits will be paid after a “double trigger” event - meaning that there

has been both a change of control, and the executive is terminated without cause or resigns for good reason within

12 months thereafter - as described in “Potential Payments Upon Termination or Change in Control.” Other than in

the case of the Change of Control Agreement for Mr. Quindlen, benefits are capped at the amounts prescribed under

Sections 280G and 4999 of the U.S. Tax Code and Logitech does not provide payments to reimburse its executive

officers for additional taxes incurred (also known as “gross-ups”) in connection with a change of control.

The Change of Control Agreement with Mr. Quindlen, which was executed in 2008, provided a tax gross-up

to reimburse him for any additional taxes incurred under Section 280G of the U.S. Tax Code in connection with

a change of control. This additional benefit was provided to Mr. Quindlen to be competitive with terms for other

CEOs at the time the agreement was approved.

In addition, under Mr. Quindlen’s employment agreement and Mr. Heid’s offer letter, if their employment

is involuntarily terminated without cause they are entitled to their base salary and target bonus as described in

“Potential Payments Upon Termination or Change in Control.” The term in Mr. Quindlen’s agreement is intended

to provide consideration for his service to Logitech and the potential length of time until subsequent employment

is secured if he is involuntarily terminated without cause. The term in Mr. Heid’s offer letter was the result of

negotiations of the terms of his employment when he joined Logitech.

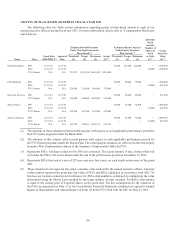

The PSU and RSU award agreements for named executive officers other than Guerrino De Luca provide for

the acceleration of vesting of the RSUs and PSUs subject to the award agreements under the same circumstances

and conditions as under the Change of Control Agreements; namely, if the named executive officer is subject to an

involuntary termination within 12 months after a change of control because his or her employment is terminated

without cause or the executive resigns for good reason. In the event of such an involuntary termination:

• AllsharessubjecttotheRSUswillvest.

• 100%ofthesharessubjecttothePSUswillvestifthechangeofcontroloccurredwithin1yearafter

the grant date of the PSUs. If the change of control occurred more than 1 year after the grant date of

the PSUs, the number of shares subject to the PSU that will vest will be determined by applying the

performance criteria under the PSUs as if the performance period had ended on the date of the change

of control.

To determine the level of benefits to be provided under each change of control agreement and other agreements,

the Committee considered the circumstances of each type of severance, the impact on shareholders, and market

practices.

Perquisites

Logitech’s executive officer benefit programs are substantially the same as for all other eligible employees

except as set out below.

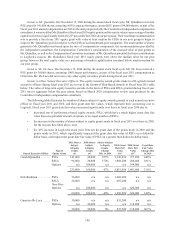

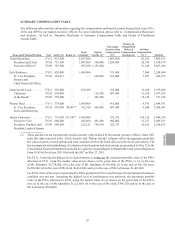

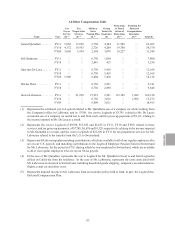

Mr. Quindlen was provided with personal tax preparation services in fiscal year 2011. Expenses related to

these services were imputed as income to Mr. Quindlen and the additional tax liabilities were paid by Logitech as

a gross-up payment. In addition, Mr. Quindlen received the use of a car and the payment of travel costs generated

when he was working out of our California office. These benefits were provided in lieu of relocating Mr. Quindlen

from his current residence. Logitech did not provide any related tax gross-up for these car and travel benefits. The

aggregate amount of Mr. Quindlen’s benefits is reflected in the Summary Compensation Table below under the

heading “All Other Compensation.”