Xerox 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

Report of Management

Our management is responsible for the integrity and

objectivity of all information presented in this annual

report. The Consolidated Financial Statements were

prepared in conformity with accounting principles

generally accepted in the United States of America

and include amounts based on management’s best

estimates and judgments.

We maintain an internal control structure designed

to provide reasonable assurance that assets are safe-

guarded against loss or unauthorized use and that

financial records are adequate and can be relied upon

to produce accurate and complete financial state-

ments. This structure includes the hiring and training

of qualified people, written accounting and control

policies and procedures, clearly drawn lines of

accountability and delegations of authority. In a busi-

ness ethics policy that is continuously communicated

to all employees, we have established our intent to

adhere to the highest standards of ethical conduct in

all of our business activities.

We monitor our internal control structure with

direct management reviews and a comprehensive

program of internal audits. In addition,

PricewaterhouseCoopers LLP, our independent audi-

tors, have audited the 2003, 2002 and 2001

Consolidated Financial Statements in accordance with

auditing standards generally accepted in the United

States of America and considered the internal controls

over financial reporting to determine their audit proce-

dures for the purpose of expressing an opinion on our

Consolidated Financial Statements.

The Audit Committee of the Board of Directors,

which is composed solely of independent directors,

meets regularly with the independent auditors, the

internal auditors and representatives of management

to review audits, financial reporting and internal con-

trol matters, as well as the nature and extent of the

audit effort. The Audit Committee is responsible for

the engagement of the independent auditors. The

independent auditors and internal auditors have free

access to the Audit Committee.

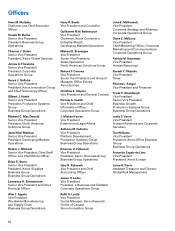

Anne M. Mulcahy

Chairman and Chief Executive Officer

Lawrence A. Zimmerman

Senior Vice President and Chief Financial Officer

Gary R. Kabureck

Vice President and Chief Accounting Officer

Report of Independent

Auditors

To the Board of Directors and Shareholders of Xerox

Corporation:

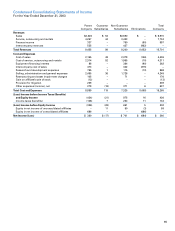

In our opinion, the accompanying consolidated bal-

ance sheets and the related consolidated statements

of income, cash flows and common shareholders’

equity present fairly, in all material respects, the finan-

cial position of Xerox Corporation and its subsidiaries

at December 31, 2003 and 2002, and the results of their

operations and their cash flows for each of the three

years in the period ended December 31, 2003 in con-

formity with accounting principles generally accepted

in the United States of America. These financial

statements are the responsibility of the Company’s

management; our responsibility is to express an

opinion on these financial statements based on our

audits. We conducted our audits of these statements in

accordance with auditing standards generally accepted

in the United States of America, which require that we

plan and perform the audit to obtain reasonable assur-

ance about whether the financial statements are free of

material misstatement. An audit includes examining,

on a test basis, evidence supporting the amounts and

disclosures in the financial statements, assessing the

accounting principles used and significant estimates

made by management, and evaluating the overall

financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

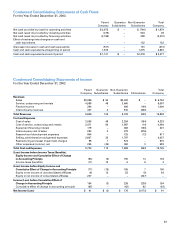

As discussed in Note 1, in 2003 the Company

adopted the provisions of the Financial Accounting

Standards Board Interpretation No. 46R,

“Consolidation of Variable Interest Entities, an

Interpretation of ARB 51,” which changed certain con-

solidation policies. Additionally, as discussed in Note

1, the Company adopted the provisions of Statement

of Financial Accounting Standards No. 142, “Goodwill

and Other Intangible Assets” on January 1, 2002.

PricewaterhouseCoopers LLP

Stamford, Connecticut

January 27, 2004