Xerox 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

and declining interest rates, 2004 net periodic pension

cost will increase. The total unrecognized actuarial

loss as of December 31, 2003 was $1.87 billion, as

compared to $1.84 billion at December 31, 2002. The

change from December 31, 2002 relates to a decline in

the discount rate, offset by improved asset returns as

compared to expected returns. The total unrecognized

actuarial loss will be amortized in the future, subject to

offsetting gains or losses that will change the future

amortization amount. We have recently utilized a

weighted average expected rate of return on plan

assets of 8.3 percent for 2003 expense, 8.8 percent for

2002 expense and 8.9 percent for 2001 expense, on a

worldwide basis. In estimating this rate, we consid-

ered the historical returns earned by the plan assets,

the rates of return expected in the future and our

investment strategy and asset mix with respect to the

plans’ funds. The weighted average rate we will utilize

to calculate our 2004 expense will be 8.1 percent.

Another significant assumption affecting our pension

and post-retirement benefit obligations and the net

periodic pension and other post-retirement benefit

cost is the rate that we use to discount our future

anticipated benefit obligations. In estimating this rate,

we consider rates of return on high quality fixed-

income investments over the period to expected pay-

ment of the pension and other benefits. The weighted

average rate we will utilize to measure our pension

obligation as of December 31, 2003 and calculate our

2004 expense will be 5.8 percent, which is a decrease

from 6.2 percent used in the determination of our pen-

sion obligations in 2003. As a result of the reduction in

the discount rate, the lower cumulative actual return

on plan assets during the prior three years and certain

other factors, our 2004 net periodic pension cost is

expected to be $65 million higher than 2003.

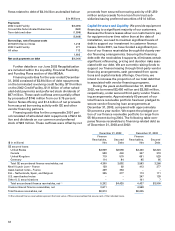

On a consolidated basis, we recognized net peri-

odic pension cost of $364 million, $168 million, and

$99 million for the years ended December 31, 2003,

2002 and 2001, respectively. Pension cost is included

in several income statement components based on

the related underlying employee costs. Pension and

post-retirement benefit plan assumptions are included

in Note 12 to the Consolidated Financial Statements.

Holding all other assumptions constant, a 0.25 percent

increase or decrease in the discount rate from the

2004 projected rate of 5.8 percent would change the

2004 projected net periodic pension cost by approxi-

mately $23 million. Likewise, a 0.25 percent increase

or decrease in the expected return on plan assets from

the 2004 projected rate of 8.1 percent would change

the 2004 projected net periodic pension cost by

approximately $9 million.

Income Taxes and Tax Valuation Allowances: We

record the estimated future tax effects of temporary

differences between the tax bases of assets and liabili-

ties and amounts reported in our Consolidated

Balance Sheets, as well as operating loss and tax cred-

it carryforwards. We follow very specific and detailed

guidelines in each tax jurisdiction regarding the recov-

erability of any tax assets recorded in our

Consolidated Balance Sheets and provide necessary

valuation allowances as required. We regularly review

our deferred tax assets for recoverability considering

historical profitability, projected future taxable income,

the expected timing of the reversals of existing tempo-

rary differences and tax planning strategies. If we con-

tinue to operate at a loss in certain jurisdictions or are

unable to generate sufficient future taxable income, or

if there is a material change in the actual effective tax

rates or time period within which the underlying tem-

porary differences become taxable or deductible, we

could be required to increase the valuation allowance

against all or a significant portion of our deferred tax

assets, resulting in a substantial increase in our effec-

tive tax rate and a material adverse impact on our

operating results. Conversely, if and when our opera-

tions in some jurisdictions were to become sufficiently

profitable to recover previously reserved deferred tax

assets, we would reduce all or a portion of the applica-

ble valuation allowance in the period when such deter-

mination is made. This would result in an increase to

reported earnings in such period. Adjustments to our

valuation allowance, through charges (credits) to

expense, were $(16) million, $15 million, and $247 mil-

lion for the years ended December 31, 2003, 2002 and

2001, respectively.

We are subject to ongoing tax examinations and

assessments in various jurisdictions. Accordingly, we

incur additional tax expense based upon the probable

outcomes of such matters. In addition, when applica-

ble, we adjust the previously recorded tax expense to

reflect examination results. Our ongoing assessments

of the probable outcomes of the examinations and

related tax positions require judgment and can materi-

ally increase or decrease our effective tax rate as well

as impact our operating results.

Legal Contingencies: We are a defendant in numerous

litigation and regulatory matters including those

involving securities law, patent law, environmental

law, employment law and ERISA, as discussed in Note

15 to the Consolidated Financial Statements. We

determine whether an estimated loss from a contin-

gency should be accrued by assessing whether a loss

is deemed probable and can be reasonably estimated.

We assess potential liability by analyzing our litigation

and regulatory matters using available information.

We develop our views on estimated losses in consul-

tation with outside counsel handling our defense in

these matters, which involves an analysis of potential

results, assuming a combination of litigation and set-

tlement strategies. Should developments in any of

these matters cause a change in our determination as

to an unfavorable outcome and result in the need to