Xerox 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

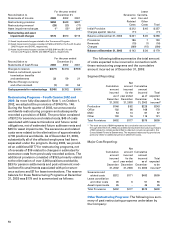

Long-Term Debt: Long-term debt, including debt

secured by finance receivables at December 31, 2003

and 2002 was as follows:

Weighted Average

Interest Rates at

U.S. Operations December 31, 2003 2003 2002

Xerox Corporation

Notes due 2003 –% $ – $ 883

Notes due 2004 7.15 194 196

Euro notes due 2004 3.50 377 315

Notes due 2006 7.25 15 15

Notes due 2007 7.38 25 25

Notes due 2008 1.45 27 25

Senior Notes due 2009 9.75 616 626

Euro Senior Notes due 2009 9.75 272 226

Senior Notes due 2010 7.13 701 –

Notes due 2011 7.01 50 50

Senior Notes due 2013 7.63 548 –

Notes due 2014 9.00 19 19

Notes due 2016 7.20 254 255

Convertible notes due 2018 – –556

2003/2002 Credit Facility 3.42 300 3,440

Other debt due 2003-2018 – –40

Subtotal $3,398 $6,671

Xerox Credit Corporation

Notes due 2003 – –463

Yen notes due 2005 1.50 936 845

Yen notes due 2007 2.00 281 255

Notes due 2008 6.50 25 25

Notes due 2012 7.12 125 125

Notes due 2013 6.50 59 59

Notes due 2014 6.06 50 50

Notes due 2018 7.00 25 25

Subtotal 1,501 1,847

Other US Operations

Borrowings secured by

finance receivables (1) 4.74 2,598 2,469

Borrowings secured by other assets 7.46 70 –

Subtotal $2,668 $ 2,469

Total U.S. Operations $7,567 $10,987

Weighted Average

International Interest Rates at

Operations December 31, 2003 2003 2002

Xerox Capital (Europe) plc:

Euros due 2003-2008 5.25% $ 942 $ 784

Japanese yen due 2003-2005 1.30 93 84

U.S. dollars due 2003-2008 5.89 525 523

Subtotal 1,560 1,391

Other International Operations:

Pound Sterling secured

borrowings due 2003 – –529

Pound Sterling secured

borrowings due 2008 (1) 6.09 570 –

Euro secured borrowings due

2005-2007 (1) 3.59 817 206

Canadian dollars secured

borrowings due 2003-2006 (1) 5.82 440 319

Other debt due 2003-2008 9.39 170 342

Subtotal 1,997 1,396

Total International Operations 3,557 2,787

Subtotal 11,124 13,774

Less current maturities 4.99 (4,194) (3,980)

Total long-term debt $6,930 $9,794

(1) Refer to Note 4 for further discussion of borrowings secured by finance

receivables, net.

Consolidated Long-Term Debt Maturities: Scheduled

payments due on long-term debt for the next five

years and thereafter follow:

2004 2005 2006 2007 2008 Thereafter Total

$4,194 $2,129 $486 $775 $782 $2,758 $11,124

Certain of our debt agreements allow us to

redeem outstanding debt prior to scheduled maturity.

The actual decision as to early redemption, when and

if possible, will be made at the time the early redemp-

tion option becomes exercisable and will be based on

liquidity, prevailing economic and business condi-

tions, and the relative costs of new borrowing.

Convertible Debt due 2018: In 1998, we issued

convertible subordinated debentures for net proceeds

of $575. The original scheduled amount due was

$1,012 which corresponded to an effective interest

rate of 3.625 percent per year. The debentures were

convertible into 7.808 shares of our common stock

per 1,000 dollars principal amount at maturity of the

debentures and also contained a put option exercis-

able in 2003. In April 2003, $560 of this convertible

debt was put back to us in accordance with terms of

the debt and was paid in cash.

Debt-for-Equity Exchanges: During 2002, we

exchanged an aggregate of $52 of debt through the

exchange of 6.4 million shares of common stock val-

ued at $51 using the fair market value at the date of