Xerox 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

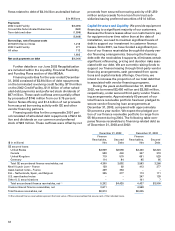

33

As of December 31, 2003 and 2002, debt secured

by finance receivables was approximately 40 percent

and 28 percent of total debt, respectively. The follow-

ing represents our aggregate debt maturity schedule

as of December 31, 2003:

Secured by

Bonds/ Finance

Bank Receiv- Total

($ in millions) Loans ables Debt

2004 $2,208 $2,028 $ 4,236(1)

2005 1,065 1,064 2,129

2006 25 461 486

2007 307 468 775

2008 378 404 782

Thereafter 2,758 – 2,758

Total $6,741 $4,425 $11,166

(1) Quarterly debt maturities for 2004 are $1,081, $1,087, $686 and $1,382 for

the first, second, third and fourth quarters, respectively.

The following table summarizes our secured and

unsecured debt as of December 31, 2003 and 2002:

($ in millions) 2003 2002

Credit Facility $ 300 $ 925

Debt secured by finance

receivables 4,425 3,900

Capital leases 29 40

Debt secured by other assets 99 90

Total Secured Debt $ 4,853 $ 4,955

Credit Facility – unsecured $ – $ 2,565

Senior Notes 2,137 852

Subordinated debt 19 575

Other Debt 4,157 5,224

Total Unsecured Debt $ 6,313 $ 9,216

Total Debt $11,166 $14,171

Liquidity, Financial Flexibility and Funding Plans: We

manage our worldwide liquidity using internal cash

management practices, which are subject to (1) the

statutes, regulations and practices of each of the local

jurisdictions in which we operate, (2) the legal require-

ments of the agreements to which we are a party and

(3) the policies and cooperation of the financial institu-

tions we utilize to maintain and provide cash manage-

ment services.

Recapitalization: In June 2003, we successfully com-

pleted a $3.6 billion Recapitalization which reduced

debt by $1.6 billion, increased common and preferred

equity by $1.3 billion and provided $0.7 billion of

additional borrowing capacity. The Recapitalization

included the offering and sale of 9.2 million shares of

6.25 percent Series C Mandatory Convertible Preferred

Stock, 46 million shares of Common Stock, $700 mil-

lion of 7.125 percent Senior Notes due 2010 and

$550 million of 7.625 percent Senior Notes due 2013,

and the closing of our $1 billion 2003 Credit Facility.

Proceeds from the Recapitalization were used to fully

repay our 2002 Credit Facility. The 2003 Credit Facility

consists of a $300 million term loan and a $700 million

revolving credit facility (which includes a $200 million

sub-facility for letters of credit). Terms of the 2003

Credit Facility and the 2010 and 2013 Senior Notes are

included in Note 10 to the Consolidated Financial

Statements. The covenants under the 2003 Credit

Facility reflect our improved financial position. For

instance, there are no mandatory prepayments under

the 2003 Credit Facility and the interest rate is approxi-

mately 2 percentage points lower than the 2002 Credit

Facility. We expect that the reduced interest expense

in 2004 attributable to the Recapitalization will largely

offset the dilutive impact of the additional common

shares issued.

2003 Credit Facility: Xerox Corporation is the only bor-

rower of the term loan. The revolving credit facility is

available, without sub-limit, to Xerox Corporation and

certain of its foreign subsidiaries, including Xerox

Canada Capital Limited, Xerox Capital (Europe) plc

and other qualified foreign subsidiaries (excluding

Xerox Corporation, the “Overseas Borrowers”). The

2003 Credit Facility matures on September 30, 2008.

Debt issuance costs of $29 million were deferred in

conjunction with the 2003 Credit Facility.

Subject to certain limits described in the following

paragraph, the obligations under the 2003 Credit

Facility are secured by liens on substantially all the

assets of Xerox and each of our U.S. subsidiaries that

have a consolidated net worth from time to time of

$100 million or more (the “Material Subsidiaries”),

excluding Xerox Credit Corporation (“XCC”) and cer-

tain other finance subsidiaries, and are guaranteed by

certain Material Subsidiaries. Xerox Corporation is

required to guarantee the obligations of the Overseas

Borrowers. As of December 31, 2003, there were no

outstanding borrowings under the revolving credit

facility. However, as of December 31, 2003, the

$300 million term loan and $51 million of letters of

credit were outstanding.

Under the terms of certain of our outstanding

public bond indentures, the amount of obligations

under the 2003 Credit Facility that can be secured, as

described above, is limited to the excess of (x) 20 per-

cent of our consolidated net worth (as defined in the

public bond indentures) over (y) the outstanding

amount of certain other debt that is secured by the

Restricted Assets. Accordingly, the amount of 2003

Credit Facility debt secured by the Restricted Assets

will vary from time to time with changes in our consol-

idated net worth. The amount of security provided

under this formula is allocated ratably to the term loan

and revolving loans outstanding at any time.

The term loan and the revolving loans each bear

interest at LIBOR plus a spread that varies between

1.75 percent and 3 percent (or, at our election, at a