Xerox 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

2003 SAG expense of $4.2 billion declined $188

million from 2002 including adverse currency impacts

of $172 million and $70 million of higher pension and

other employee benefit costs. 2003 SAG reductions

reflect improved productivity and employment reduc-

tions associated with our cost base restructuring,

lower bad debt expenses of $109 million and the

absence of 2002 expenses discussed below.

2002 SAG expense of $4.4 billion declined

$291 million from 2001. The reduction includes lower

bad debt expenses of $106 million, lower SOHO

spending of $84 million and a $34 million favorable

property tax adjustment in North America. These

decreases were partially offset by $106 million of inter-

nal-use software impairment charges, $65 million of

higher advertising and marketing communications

spending, $18 million of increased professional fees

and $26 million of losses associated with the exit from

certain leased facilities. The balance of the reduction

primarily reflects employment reductions associated

with our cost base restructuring actions.

Bad debt expense included in SAG was $224 mil-

lion, $332 million and $438 million in 2003, 2002 and

2001, respectively. The 2003 reduction reflects

improved collections performance, receivables aging

and write-off trends. Lower expense in 2002 is due to

improved customer administration, collection prac-

tices and credit approval policies, as well as our rev-

enue declines. Bad debt expense as a percent of total

revenue was 1.4 percent, 2.1 percent and 2.6 percent

for 2003, 2002 and 2001, respectively.

Restructuring Programs: For the three years ended

December 31, 2003, we have engaged in a series of

restructuring programs, resulting in approximately

$1.6 billion in charges related to downsizing our

employee base, exiting certain businesses, outsourcing

some internal functions and engaging in other actions

designed to reduce our cost structure. In 2003, we

recorded restructuring and asset impairment charges of

$176 million, primarily consisting of new severance

actions and pension settlements related to previous

employee restructuring actions. We expect prospective

annual savings associated with 2003 actions to be

approximately $170 million, as compared to 2003 levels.

Restructuring and asset impairment charges of $670

million and $715 million in 2002 and 2001, respectively,

primarily relate to severance and employee benefits

related to worldwide terminations as well as certain

costs related to the consolidation of excess facilities. The

remaining restructuring reserve balance at December

31, 2003 for all programs was $221 million. Charges

related to previous employee restructuring actions of

approximately $20 million are expected to be recorded

in 2004, primarily related to pension settlements.

Worldwide employment declined by approximately

6,700 in 2003, to approximately 61,100, primarily reflect-

ing reductions as part of our restructuring programs.

Worldwide employment was approximately 67,800 and

78,900 at December 31, 2002 and 2001, respectively.

Gain on Affiliate’s Sale of Stock: In 2003, we recorded

cumulative gains on an affiliate’s sale of stock of

$13 million reflecting our proportionate share of the

increase in equity of ScanSoft Inc., an equity invest-

ment. The gain resulted from ScanSoft’s issuance of

stock in connection with its acquisition of Speechworks,

Inc. ScanSoft is a developer of digital imaging soft-

ware that enables users to leverage the power of their

scanners, digital cameras and other electronic devices.

In 2001, the gain on affiliate’s sale of stock of $4 mil-

lion reflected our proportionate share of the increase

in equity of ScanSoft Inc., resulting from issuance of

their stock in connection with an acquisition.

Provision for Litigation: In 2003, we recorded a

$239 million provision for litigation relating to the

court approved settlement of the Berger v. Retirement

Income Guarantee Plan (RIGP) litigation which is dis-

cussed in more detail in Note 15 to the Consolidated

Financial Statements.

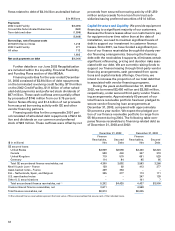

Other Expenses, Net: Other expenses, net for the three

years ended December 31, 2003 consisted of the fol-

lowing:

Year Ended December 31,

($ in millions) 2003 2002 2001

Non-financing interest expense $522 $495 $544

Interest income (65) (77) (101)

Net currency losses (gains) 11 77 (29)

Legal and regulatory matters 337 –

Amortization of goodwill (2001

only) and intangible assets 36 36 94

Loss (gain) on early

extinguishment of debt 73 (1) (63)

Business divestiture and asset

sale losses (gains) 13 (1) 10

Minorities’ interests in earnings

of subsidiaries 632

All other, net 38 24 53

$637 $593 $510

Non-financing interest expense: 2003 non-financing

interest expense was $27 million higher than 2002,

primarily reflecting 2003 net losses of $13 million

from the mark-to-market valuation of our interest rate

swaps compared to gains of $12 million in 2002. Due

to the inherent volatility in the interest rate markets,

we are unable to predict the amount of the above

noted mark-to-market gains or losses in future peri-

ods. 2003 non-financing interest expense included

higher interest rates and borrowing costs in the first

half of the year associated with the terms of the 2002

Credit Facility. These increased expenses were offset

by lower borrowing costs in the second half of 2003

following the June 2003 Recapitalization.