Xerox 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

from us one three-hundredth of a new series of pre-

ferred stock at an exercise price of $250. Within the

time limits and under the circumstances specified in

the plan, the Rights entitle the holder to acquire either

our common stock, the stock of the surviving compa-

ny in a business combination, or the stock of the pur-

chaser of our assets, having a value of two times the

exercise price. The Rights, which expire in April 2007,

may be redeemed prior to becoming exercisable by

action of the Board of Directors at a redemption price

of $.01 per Right. The Rights are non-voting and, until

they become exercisable, have no dilutive effect on

the earnings per share or book value per share of our

common stock.

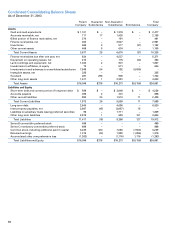

Note 17 – Common Stock

We have 1.75 billion authorized shares of common

stock, $1 par value. At December 31, 2003, 138 million

shares were reserved for issuance under our incentive

compensation plans. In addition, at December 31, 2003,

2 million common shares were reserved for the con-

version of convertible debt, 31 million common shares

were reserved for conversion of Series B Convertible

Preferred Stock, 113 million common shares were

reserved for the conversion of Convertible Securities

related to our liability to Trust II, 90 million common

shares were reserved for the conversion of the Series C

Mandatory Convertible Preferred Stock and 48 million

common shares were reserved for debt to equity

exchanges.

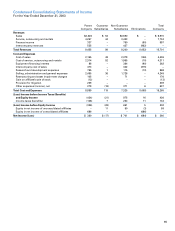

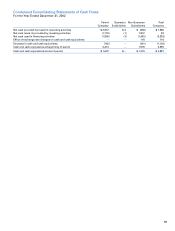

2003 2002 2001

Average Average Average

Stock Option Stock Option Stock Option

Employee Stock Options Options Price Options Price Options Price

Outstanding at January 1 76,849 $26 68,829 $29 58,233 $35

Granted 31,106 10 14,286 10 15,085 5

Cancelled (6,840) 21 (5,668) 34 (4,479) 28

Exercised (3,276) 6 (598) 5 (10) 5

Outstanding at December 31 97,839 21 76,849 26 68,829 29

Exercisable at end of year 58,652 45,250 36,388

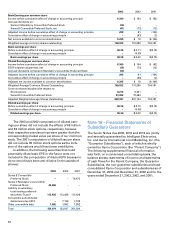

Stock Option and Long-term Incentive Plans: We have

a long-term incentive plan whereby eligible employees

may be granted non-qualified stock options, shares of

common stock (restricted or unrestricted) and stock

appreciation rights (“SARs”). Stock options and stock

awards are settled with newly issued shares of our

common stock, while SARs are settled with cash.

We granted 1.6 million, 1.6 million and 1.9 million

shares of restricted stock to key employees for the years

ended December 31, 2003, 2002 and 2001, respectively.

No monetary consideration is paid by employees who

receive restricted shares. Compensation expense for

restricted grants is based upon the grant date market

price and is recorded over the vesting period which on

average ranges from one to three years. Compensation

expense recorded for restricted grants was $15, $17 and

$15 in 2003, 2002 and 2001, respectively.

SARs permit the employee to receive cash equal

to the excess of the market price at date of exercise

over the market price at the date of grant. SARs gener-

ally vest over a three-year period and expire 10 years

from the date of grant. In 2003, we recorded $2 of

compensation expense relating to SARs.

Stock options generally vest over a period of six

months to three years and expire between eight and

ten years from the date of grant. The exercise price of

the options is equal to the market value of our com-

mon stock on the effective date of grant.

At December 31, 2003 and 2002, 21.4 million and

43.2 million shares, respectively, were available for

grant of options or awards. The following table pro-

vides information relating to the status of, and changes

in, stock options granted for each of the three years

ended December 31, 2003 (stock options in thousands):