Xerox 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

ments that ensure that both parties have access to

each other’s portfolio of patents, technology and prod-

ucts. Fuji Xerox continues to provide products to us as

well as collaborate with us on R&D.

Flextronics Manufacturing Outsourcings: In the fourth

quarter of 2001, we entered into purchase and supply

agreements with Flextronics, a global electronics manu-

facturing services company. Under the agreements,

Flextronics purchased related inventory, property and

equipment. Pursuant to the purchase agreement, we

sold our operations in Toronto, Canada; Aguascalientes,

Mexico, Penang, Malaysia, Venray, The Netherlands

and Resende, Brazil to Flextronics in a series of transac-

tions, which were completed in 2002. In total, approxi-

mately 4,100 Xerox employees in certain of these

operations transferred to Flextronics. Total proceeds

from the sales in 2002 and 2001 were $167, plus the

assumption of certain liabilities, representing a premi-

um over book value. The premium is being amortized

over the life of the supply contract.

Under the supply agreement, Flextronics manufac-

tures and supplies equipment and components, includ-

ing electronic components, for the Office segment of

our business. This represents approximately 50 per-

cent of our overall worldwide manufacturing opera-

tions. The initial term of the Flextronics supply

agreement is five years subject to our right to extend

for two years. Thereafter it will automatically be

renewed for one-year periods, unless either party

elects to terminate the agreement. We have agreed to

purchase from Flextronics most of our requirements

for certain products in specified product families. We

also must purchase certain electronic components

from Flextronics so long as Flextronics meets certain

pricing requirements. Flextronics must acquire inven-

tory in anticipation of meeting our forecasted require-

ments and must maintain sufficient manufacturing

capacity to satisfy such forecasted requirements.

Under certain circumstances, we may become obligat-

ed to repurchase inventory that remains unused for

more than 180 days, becomes obsolete or upon termi-

nation of the supply agreement. Our remaining manu-

facturing operations are primarily located in Rochester,

NY for our high end production products and consum-

ables and Wilsonville, OR for consumable supplies and

components for the Office segment products.

Note 4 – Receivables, Net

Finance Receivables: Finance receivables result from

installment arrangements and sales-type leases aris-

ing from the marketing of our equipment. These

receivables are typically collateralized by a security

interest in the underlying assets. The components of

Finance receivables, net at December 31, 2003 and

2002 follow:

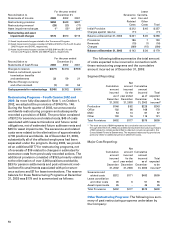

2003 2002

Gross receivables $10,599 $10,685

Unearned income (1,651) (1,628)

Unguaranteed residual values 180 272

Allowance for doubtful accounts (315) (324)

Finance receivables, net 8,813 9,005

Less: Billed portion of finance

receivables, net (461) (564)

Current portion of finance

receivables not billed, net (2,981) (3,088)

Amounts due after one year, net $ 5,371 $ 5,353

Contractual maturities of our gross finance receiv-

ables subsequent to December 31, 2003 follow

(including those already billed of $461):

There-

2004 2005 2006 2007 2008 after Total

$4,206 $2,862 $1,948 $1,098 $401 $84 $10,599

Our experience has shown that a portion of these

finance receivables will be prepaid prior to maturity.

Accordingly, the preceding schedule of contractual

maturities should not be considered a forecast of

future cash collections.

Vendor Financing Initiatives: In 2002, we completed an

agreement (the “Loan Agreement”), under which GE

Vendor Financial Services, a subsidiary of GE, became

the primary equipment financing provider in the U.S.,

through monthly fundings of our new lease origina-

tions. In March 2003, the agreement was amended to

allow for the inclusion of state and local governmental

contracts in future fundings.

Under the agreement, GE is expected to fund a

significant portion of new U.S. lease originations at

over-collateralization rates, which will vary over time,

but are expected to approximate 10 percent at the

inception of each funding. The securitizations are sub-

ject to interest rates calculated at each monthly loan

occurrence at yield rates consistent with average rates

for similar market based transactions. Refer to Note 10

for further information on interest rates. The funds

received under this agreement are recorded as

secured borrowings and the associated receivables

are included in our Consolidated Balance Sheet. GE’s

funding commitment is not subject to our credit rat-

ings. There are no credit rating defaults that could

impair future funding under this agreement. This

agreement contains cross default provisions related to

certain financial covenants contained in the 2003

Credit Facility and other significant debt facilities. Any

default would impair our ability to receive subsequent

funding until the default was cured or waived but

does not accelerate previous borrowings. However, in

the event of a default, we could be replaced as the

maintenance service provider for the associated

equipment under lease.