Xerox 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Ridge Reinsurance Limited (“Ridge Re”) and a per-

formance-based instrument relating to the 1997 sale of

The Resolution Group (“TRG”).

Ridge Re: We provide aggregate excess of loss reinsur-

ance coverage (the Reinsurance Agreement) to one of

the former Talegen units, TRG, through Ridge Re, a

wholly-owned subsidiary. The coverage limit for this

remaining Reinsurance Agreement is $578. We have

guaranteed that Ridge Re will meet all its financial obli-

gations under the remaining Reinsurance Agreement.

Ridge Re maintains an investment portfolio in a trust

that is required to provide security with respect to

aggregate excess of loss reinsurance obligations under

the remaining Reinsurance Agreement. At December

31, 2003 and 2002, the balance of the investments in

the trust, consisting of U.S. government, government

agency and high quality corporate bonds, was $531

and $759, respectively. Our remaining net investment

in Ridge Re was $77 and $325 at December 31, 2003

and 2002, respectively. Based on Ridge Re’s current

projections of investment returns and reinsurance

payment obligations, we expect to fully recover our

remaining investment. The projected reinsurance pay-

ments are based on actuarial estimates. The decline in

our net investment in 2003 primarily relates to a return

of previously restricted cash pursuant to terms of the

underlying insurance contracts.

Performance-Based Instrument: In connection with

the 1997 sale of TRG, we received a $462 perform-

ance-based instrument as partial consideration. Cash

distributions are paid on the instrument, based on

72.5 percent of TRG’s available cash flow as defined in

the sale agreement. For the years ended December 31,

2003 and 2002, we received cash distributions of $23

and $24, respectively. The recovery of this instrument

is dependent upon the sufficiency of TRG’s available

cash flows. Such cash flows are supported by TRG’s

ultimate parent via a subscription agreement whereby

the parent has agreed to purchase from TRG an estab-

lished number of shares of this instrument each year

through 2017. Based on current cash flow projections,

we expect to fully recover the $387 remaining balance

of this instrument.

Internal Use Software: Capitalized direct costs associ-

ated with developing, purchasing or otherwise acquir-

ing software for internal use are amortized on a

straight-line basis over the expected useful life of the

software, beginning when the software is implement-

ed. The software useful lives generally vary from 3 to 5

years. Amortization expense, including applicable

impairment charges, was $63, $215, and $132 for the

years ended December 31, 2003, 2002 and 2001,

respectively.

Investments in non-affiliated companies: This caption

includes marketable securities classified as “available

for sale” instruments in accordance with SFAS No.

115, “Accounting for Certain Investments in Debt and

Equity Securities.” These investments have an original

cost of $51 and are reflected in the consolidated finan-

cial statements at their quoted fair value, based on

publicly traded common shares, of $68. For the year

ended December 31, 2003, the Company recorded net

unrealized gains of $17 within Accumulated Other

Comprehensive Loss.

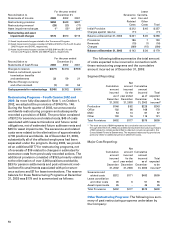

Note 10 – Debt

Short-Term Debt: Short-term borrowings at December

31, 2003 and 2002 were as follows:

2003 2002

Notes payable $ 42 $ 20

Euro secured borrowing –377

Total short-term debt 42 397

Current maturities of long-term debt 4,194 3,980

Total $4,236 $4,377

We classify our debt based on the contractual

maturity dates of the underlying debt instruments or

as of the earliest put date available to the debt holders.

We defer costs associated with debt issuance over the

applicable term or to the first put date, in the case of

convertible debt or debt with a put feature. Total

deferred debt issuance costs included in Other long-

term assets were $79 as of December 31, 2003. These

costs are amortized as interest expense in our

Consolidated Statement of Income.