Xerox 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

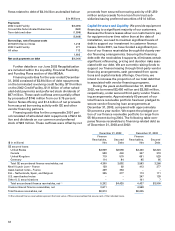

Flextronics during 2004 and expect to increase this

level commensurate with our sales in the future.

Fuji Xerox: We had product purchases from Fuji Xerox

totaling $871 million, $727 million, and $598 million in

2003, 2002 and 2001, respectively. Our purchase com-

mitments with Fuji Xerox are in the normal course of

business and typically have a lead time of three

months. We anticipate that we will purchase approxi-

mately $1 billion of products from Fuji Xerox in 2004.

Related party transactions with Fuji Xerox are disclosed

in Note 7 to the Consolidated Financial Statements.

Other Purchase Commitments: We enter into other

purchase commitments with vendors in the ordinary

course of business. Our policy with respect to all

purchase commitments is to record losses, if any,

when they are probable and reasonably estimable.

We currently do not have, nor do we anticipate,

material loss contracts.

EDS Contract: We have an information management

contract with Electronic Data Systems Corp. to pro-

vide services to us for global mainframe system pro-

cessing, application maintenance and enhancements,

desktop services and helpdesk support, voice and

data network management, and server management.

In 2001, we extended the original ten-year contract

through June 30, 2009. Although there are no mini-

mum payments required under the contract, we antic-

ipate making the following payments to EDS over the

next five years (in millions): 2004—$331; 2005—$332;

2006—$317; 2007—$307; 2008—$302. The estimated

payments are the result of an EDS and Xerox Global

Demand Case process that has been in place for eight

years. Twice a year, using this estimating process

based on historical activity, the parties agree on a pro-

jected volume of services to be provided under each

major element of the contract. Pricing for the base

services (which are comprised of global mainframe

system processing, application maintenance and

enhancements, desktop services and help desk sup-

port, voice and data management) were established

when the contract was signed in 1994 based on our

actual costs in preceding years. The pricing was modi-

fied through comparisons to industry benchmarks

and through negotiations in subsequent amend-

ments. Prices and services for the period July 1, 2004

through June 30, 2009 are currently being negotiated

and, as such, are subject to change. Under the current

contract, we can terminate the contract with six

months notice, as defined in the contract, with no ter-

mination fee and with payment to EDS for incurred

costs as of the termination date. We have an option to

purchase the assets placed in service under the EDS

contract, should we elect to terminate the contract

and either operate those assets ourselves or enter a

separate contract with a similar service provider.

Off-Balance Sheet Arrangements:

As discussed in Note 1 to the Consolidated Financial

Statements, in December 2003, we adopted Financial

Accounting Standards Board Interpretation No. 46R

“Consolidation of Variable Interest Entities, an interpre-

tation of ARB 51” (“FIN 46R”). As a result of our adop-

tion of FIN 46R, we deconsolidated certain subsidiary

trusts which were previously consolidated. All periods

presented have been reclassified to reflect this change.

As discussed further in Note 14 to the Consolidated

Financial Statements, “Liability to Subsidiary Trusts

Issuing Preferred Securities,” these trusts previously

issued preferred securities. Although the preferred

securities issued by these subsidiaries are not reflected

on our consolidated balance sheets, we have reflected

our obligations to them in the liability caption, “Liability

to Subsidiary Trusts Issuing Preferred Securities.” The

nature of our obligations to these deconsolidated sub-

sidiaries are discussed in Note 14.

Although we generally do not utilize off-balance

sheet arrangements in our operations, we enter into

operating leases in the normal course of business.

The nature of these lease arrangements is discussed

in Note 6 to the Consolidated Financial Statements.

Additionally, we utilize special purpose entities

(“SPEs”) in conjunction with certain vendor financing

transactions. The SPEs utilized in conjunction with

these transactions are consolidated in our financial

statements in accordance with applicable accounting

standards. These transactions, which are discussed

further in Note 4 to the Consolidated Financial

Statements, have been accounted for as secured bor-

rowings with the debt and related assets remaining

on our balance sheets. Although the obligations relat-

ed to these transactions are included in our balance

sheet, recourse is generally limited to the secured

assets and no other assets of the Company.

Financial Risk Management:

As a multinational company, we are exposed to mar-

ket risk from changes in foreign currency exchange

rates and interest rates that could affect our results of

operations and financial condition. As a result of our

improved liquidity and financial position, our ability to

utilize derivative contracts as part of our risk manage-

ment strategy, described below, has substantially

improved. Certain of these hedging arrangements do

not qualify for hedge accounting treatment under

SFAS 133. Accordingly, our results of operations are

exposed to some volatility, which we attempt to mini-

mize or eliminate whenever possible. The level of

volatility will vary with the level of derivative hedges

outstanding, as well as the currency and interest rate

market movements in the period.

We enter into limited types of derivative contracts,

including interest rate swap agreements, foreign cur-