Xerox 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

same as those described in the summary of significant

accounting policies included in Note 1.

The Production segment includes black and white

products which operate at speeds over 90 pages per

minute and color products which operate at speeds

over 40 pages per minute. Products include the

DocuTech, DocuPrint, Xerox 1010 and Xerox 2101 and

DocuColor families, as well as older technology light-

lens products. These products are sold, predominantly

through direct sales channels in North America and

Europe, to Fortune 1000, graphic arts, government,

education and other public sector customers.

The Office segment includes black and white prod-

ucts which operate at speeds up to 90 pages per

minute and color devices up to 40 pages per minute.

Products include our family of Document Centre digi-

tal multifunction products and our new suite of

CopyCentre, WorkCentre, and WorkCentre Pro digital

multifunction systems, DocuColor color multifunction

products, color laser, solid ink and monochrome laser

desktop printers, digital and light-lens copiers and fac-

simile products. These products are sold through

direct and indirect sales channels in North America

and Europe to global, national and mid-size commer-

cial customers as well as government, education and

other public sector customers.

The DMO segment includes our operations in

Latin America, the Middle East, India, Eurasia, Russia

and Africa. This segment includes sales of products

that are typical to the aforementioned segments, how-

ever, management serves and evaluates these mar-

kets on an aggregate geographic basis, rather than on

a product basis.

The segment classified as Other, includes several

units, none of which met the thresholds for separate

segment reporting. This group primarily includes

Xerox Supplies Group (predominantly paper), Small

Office/Home Office (“SOHO”), Xerox Engineering

Systems, Xerox Technology Enterprises and consult-

ing services, royalty and license revenues. Other seg-

ment profit (loss) includes the operating results from

these entities, other less significant businesses, our

equity income from Fuji Xerox, and certain costs

which have not been allocated to the Production,

Office and DMO segments including non-financing

interest and other corporate costs.

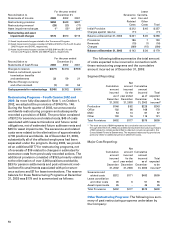

Selected financial information for our operating

segments for each of the three years ended December

31, 2003 was as follows:

Production Office DMO Other Total

2003 (1)

Information about profit or loss:

Revenues $4,171 $7,108 $1,607 $1,818 $14,704

Finance income 376 595 9 17 997

Total segment revenues $4,547 $7,703 $1,616 $1,835 $15,701

Interest expense (2) $ 121 $ 181 $ 34 $ 548 $ 884

Segment profit (loss) (3)(4) 422 753 151 (411) 915

Equity in net income of unconsolidated affiliates –165158

2002 (1)

Information about profit or loss:

Revenues $4,128 $6,940 $1,742 $2,039 $14,849

Finance income 394 601 16 (11) 1,000

Total segment revenues $4,522 $7,541 $1,758 $2,028 $15,849

Interest expense (2) $ 157 $ 223 $ 17 $ 499 $ 896

Segment profit (loss) (3)(4) 450 621 91 (329) 833

Equity in net income of unconsolidated affiliates – – 5 49 54

2001 (1)

Information about profit or loss:

Revenues $4,288 $7,356 $2,000 $2,235 $15,879

Finance income 439 661 26 3 1,129

Total segment revenues $4,727 $8,017 $2,026 $2,238 $17,008

Interest expense (2) $ 217 $ 304 $ 48 $ 432 $ 1,001

Segment profit (loss) (3)(4) 372 427 (97) (398) 304

Equity in net income of unconsolidated affiliates – – 4 49 53

(1) Asset information on a segment basis is not disclosed as this information is not separately identified and internally reported to our chief executive officer.

(2) Interest expense includes equipment financing interest as well as non-financing interest, which is a component of Other expenses, net.

(3) Other segment profit (loss) includes net corporate expenses of $529, $362 and $130 for the years ended December 31, 2003, 2002 and 2001, respectively.

Corporate expenses include interest expense associated with our liability to subsidiary trusts issuing preferred securities (see Note 14).

(4) Depreciation and amortization expense is recorded in cost of sales, research and development expenses and selling, administrative and general expenses and

is included in the segment profit (loss) above. This information is neither identified nor internally reported to our chief executive officer. These expenses are

recorded by our operating units in the accounting records based on individual assessments as to how the related assets are used. The separate identification

of this information for purposes of segment disclosure is impracticable, as it is not readily available and the cost to develop it would be excessive.