Xerox 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

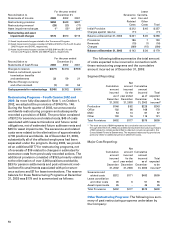

The following is a reconciliation of segment profit

to total company pre-tax income (loss):

Years ended December 31, 2003 2002 2001

Total segment profit $ 915 $ 833 $ 304

Unallocated items:

Restructuring and asset

impairment charges (176) (670) (715)

Gain on early extinguishment

of debt ––63

Restructuring related inventory

write-down charges –(2) (42)

Provision for litigation (239) ––

Gain on sale of Fuji Xerox interest –– 773

Other expenses (6) (3) (2)

Allocated item:

Equity in net income of

unconsolidated affiliates (58) (54) (53)

Pre-tax income $ 436 $ 104 $ 328

Geographic area data was as follows:

Revenues Long-Lived Assets (1)

2003 2002(2) 2001 2003 2002 2001

United States $ 8,547 $ 9,096 $10,034 $1,477 $1,524 $1,880

Europe 4,863 4,425 5,039 616 718 767

Other Areas 2,291 2,328 1,935 460 379 706

Total $15,701 $15,849 $17,008 $2,553 $2,621 $3,353

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) on-lease equipment, net, and (iii) capitalized software costs, net.

(2) Amounts have been revised to reflect reclassification of revenues previously reported in the United States.

Note 9 – Supplementary Financial

Information

The components of other current assets and other cur-

rent liabilities at December 31, 2003 and 2002 were as

follows:

2003 2002

Other current assets

Deferred taxes $ 402 $ 449

Restricted cash 386 263

Prepaid expenses 35 140

Financial derivative instruments 24 85

Other 258 250

Total $1,105 $1,187

Other current liabilities

Income taxes payable $ 264 $ 236

Other taxes payable 289 177

Interest payable 147 187

Restructuring reserves 180 286

Due to Fuji Xerox 111 117

Financial derivative instruments 51 70

Other 610 760

Total $1,652 $1,833

The components of other long-term assets and

other long-term liabilities at December 31, 2003 and

2002 were as follows:

2003 2002

Other long-term assets

Prepaid pension costs $ 736 $ 611

Net investment in discontinued operations 449 728

Internal use software, net 307 341

Restricted cash 343 414

Investments in non-affiliated companies 104 24

Financial derivative instruments 89 122

Debt issuance costs 79 159

Other 370 351

Total other long-term assets $2,477 $2,750

Other long-term liabilities

Deferred and other tax liabilities $ 809 $ 831

Minorities’ interests in equity of subsidiaries 102 73

Financial derivative instruments 11 14

Other 356 299

Total other long-term liabilities $1,278 $1,217

Net investment in discontinued operations: Our net

investment in discontinued operations is primarily

related to the disengagement from our former insur-

ance holding company, Talegen Holdings, Inc.

(“Talegen”), and consists of our net investment in