Xerox 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

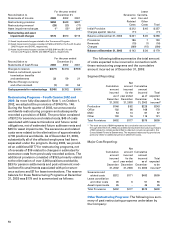

• Turnaround Program: The Turnaround Program was

initiated in October 2000 to reduce costs, improve

operations, transition customer equipment financing

to third-party vendors and sell certain assets. This pro-

gram included the outsourcing of certain Office oper-

ating segment manufacturing to Flextronics, as

discussed in Note 3. Overall, approximately 11,200

positions were eliminated under this program.

• SOHO Disengagement: In 2001, we commenced a

separate restructuring program associated with the

disengagement from our worldwide small office/home

office (“SOHO”) business. The program included pro-

visions for the elimination of approximately 1,200

positions worldwide by the end of 2001, the closing of

facilities and the write down of certain assets to net

realizable value.

• March 2000/April 1998 Programs: These programs

were likewise initiated to reduce overall costs and

included reductions in workforce as well as the consol-

idation of facilities on a worldwide basis. Overall,

approximately 14,200 positions were eliminated

under these programs.

Reversals of prior period charges were recorded

for these programs during the three-year period

ended December 31, 2003 primarily as a result of

changes in estimates associated with employee

severance and related costs.

Note 3 – Divestitures and Other Sales

During the three years ended December 31, 2003, the

following transactions occurred:

Xerox Engineering Systems: In the second quarter 2003,

we sold our XES subsidiaries in France and Germany

for a nominal amount and recognized a loss of $12.

South Africa: In the second quarter 2003, we sold our

interests in our South African affiliate for proceeds of

$29 and recognized a gain of $4.

Nigeria: In December 2002, we sold our remaining

investment in Nigeria for a nominal amount and rec-

ognized a loss of $35, primarily representing cumula-

tive translation adjustment losses which were

previously unrealized.

Licensing Agreement: In September 2002, we signed a

license agreement with a third party, related to a

nonexclusive license for the use of certain of our exist-

ing patents. In October 2002, we received proceeds of

$50 and granted the license. We have no continuing

obligation or other commitments to the third party

and recorded the income associated with this transac-

tion as revenue in Service, outsourcing and rentals in

the accompanying Consolidated Statement of Income.

Katun Corporation: In July 2002, we sold our 22 per-

cent investment in Katun Corporation, a supplier of

aftermarket copier/printer parts and supplies, for net

proceeds of $67. This sale resulted in a pre-tax gain of

$12, which is included in Other expenses, net, in the

accompanying Consolidated Statements of Income.

After-tax, the sale was essentially break-even, as the

taxable basis of Katun was lower than our carrying

value on the sale date resulting in a high rate of

income tax.

Italy Leasing Business: In April 2002, we sold our leas-

ing business in Italy to a company now owned by GE

for $200 in cash plus the assumption of $20 of debt.

This sale is part of an agreement under which GE, as

successor, provides ongoing, exclusive equipment

financing to our customers in Italy. The total pre-tax

loss on this transaction, which is included in Other

expenses, net, in the accompanying Consolidated

Statements of Income, was $27 primarily related to

recognition of cumulative translation adjustment loss-

es and final sale contingency settlements.

Prudential Insurance Company Common Stock: In the

first quarter of 2002, we sold common stock of

Prudential Insurance Company associated with that

company’s demutualization. In connection with this

sale, we recognized a pre-tax gain of $19 that is includ-

ed in Other Expenses, net, in the accompanying

Consolidated Statements of Income.

Delphax: In December 2001, we sold Delphax Systems

and Delphax Systems, Inc. (“Delphax”) to Check

Technology Canada LTD and Check Technology

Corporation for $16. The transaction was essentially

break-even. Delphax designs, manufactures and sup-

plies high-speed electron beam imaging digital print-

ing systems and related parts, supplies and services.

Nordic Leasing Business: In April 2001, we sold our

leasing businesses in four Nordic countries to a com-

pany now owned by GE, for $352 in cash and retained

interests in certain finance receivables for total pro-

ceeds of approximately $370 which approximated

book value. These sales are part of an agreement

under which that company will provide ongoing,

exclusive equipment financing to our customers in

those countries.

Fuji Xerox Interest: In March 2001, we sold half of our

ownership interest in Fuji Xerox to Fuji Photo Film Co.,

Ltd (“Fuji Film”) for $1.3 billion in cash. In connection

with the sale, we recorded a pre-tax gain of $773.

Under the agreement, Fuji Film’s ownership interest in

Fuji Xerox increased from 50 percent to 75 percent.

Our ownership interest decreased to 25 percent and

we retain significant rights as a minority shareholder.

We have product distribution and technology agree-