Xerox 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

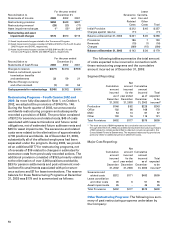

50

For the year ended

Reconciliation to December 31,

Statements of Income 2003 2002 2001

Restructuring provision $204 $648 $587

Restructuring reversal (29) (33) (77)

Asset impairment charges 1(1) 55(2) 205(3)

Restructuring and asset

impairment charges $176 $670 $715

(1) Asset impairment charges related to the Turnaround Program.

(2) Asset impairment charges consisted of $45 and $10 for the Fourth Quarter

2002 Program and SOHO, respectively.

(3) Asset impairment charges consisted of $28, $164 and $13 for the

Turnaround Program, SOHO and 2000 Program, respectively.

For the year ended

Reconciliation to December 31,

Statements of Cash Flows 2003 2002 2001

Charges to reserve $(377) $(474) $(555)

Pension curtailment, special

termination benefits

and settlements 33 59 21

Effects of foreign currency

and other noncash (1) 23 50

Cash payments for restructurings $(345) $(392) $(484)

Restructuring Programs – Fourth Quarter 2002 and

2003: As more fully discussed in Note 1, on October 1,

2002, we adopted the provisions of SFAS No. 146.

During the fourth quarter of 2002, we announced a

worldwide restructuring program and subsequently

recorded a provision of $402. The provision consisted

of $312 for severance and related costs, $45 of costs

associated with lease terminations and future rental

obligations, net of estimated future sublease rents and

$45 for asset impairments. The severance and related

costs were related to the elimination of approximately

4,700 positions worldwide. As of December 31, 2003,

substantially all of the affected employees had been

separated under the program. During 2003, we provid-

ed an additional $177 for restructuring programs, net

of reversals of $16 related to changes in estimates for

severance costs from previously recorded actions. The

additional provision consisted of $153 primarily related

to the elimination of over 2,000 positions worldwide,

$33 for pension settlements and post-retirement med-

ical benefit curtailments associated with prior sever-

ance actions and $7 for lease terminations. The reserve

balance for these Restructuring Programs at December

31, 2003 was $179 and is summarized as follows:

Lease

Severance Cancella-

and tion and

Related Other

Costs Costs Total

Initial Provision $ 312 $ 45 $ 357

Charges against reserve (71) – (71)

Balance at December 31, 2002 $ 241 $ 45 $ 286

Provisions 186 7 193

Reversals (15) (1) (16)

Charges (269) (15) (284)

Balance at December 31, 2003 $ 143 $ 36 $ 179

The following tables summarize the total amount

of costs expected to be incurred in connection with

these restructuring programs and the cumulative

amount incurred as of December 31, 2003:

Segment Reporting:

Net

Cumulative amount Cumulative

amount incurred amount

incurred for the incurred Total

as of year ended as of expected

December December December to be

31, 2002 31, 2003 31, 2003 incurred*

Production $146 $ 82 $228 $243

Office 102 66 168 178

DMO 54 13 67 67

Other 100 16 116 121

Total Provisions $402 $177 $579 $609

* The total amount of $609 represents the cumulative amount incurred

through December 31, 2003 plus additional expected restructuring charges

of $30 related to initiatives identified to date but not yet recognized in the

Consolidated Financial Statements. The expected restructuring provisions

primarily relate to additional pension settlement costs.

Major Cost Reporting:

Net

Cumulative amount Cumulative

amount incurred amount

incurred for the incurred Total

as of year ended as of expected

December December December to be

31, 2002 31, 2003 31, 2003 incurred*

Severance and

related costs $312 $171 $483 $509

Lease cancellation

and other costs 45 6 51 55

Asset impairments 45 – 45 45

Total Provisions $402 $177 $579 $609

Other Restructuring Programs: The following is a sum-

mary of past restructuring programs undertaken by

the Company: